From Here To Eternity, Hungarian Style

By Edward Hugh

This post first appeared on my Roubini Global EconoMonitor Blog “Don’t Shoot The Messenger“.

Hungary’s unofficial ambassador to the IMF,Tamás Fellegi, is reportedly facing a “terrible atmosphere” after his arrival in Washington on an exploratory mission whose objective is to open up communication about a new financial lifeline for the country. Frankly, given the recent record of relations between the two institutions involved it isn’t hard to understand why. Leaving aside the long list of recent grievances, it was Hungary who decided to walk away from the IMF in the first place, suggesting it could manage quite well on its own, thank you very much, so the Washington based lender is now hardly likely to welcome the country back as some sort of long lost prodigal son.

To make matters worse, the country has now opened up a second front by generating a serious dispute with the EU Commission, and other European institutions like the ECB, so it is only to be expected that the Fund will not reach any sort of agreement with the Hungarian government, until after the path has been cleared at the Brussels level. Indeed such is the degree of dishumour of Europe’s leaders with the present government, that it is still not clear whether the price for any form of aid might not be Orban’s own head, and the installation of a more technocratic caretaker government. There are, after all, recent precedents for such a development in Greece and Hungary, and indeed the former Hungarian prime minister Ferenc Gyurcsány was effectively forced out by Brussels in March 2009.

Not unnaturally Viktor Orban has been visibly trying to back away from the rapidly deteriorating confrontation, and only last Friday said his administration believes striking a deal with the European Union and the International Monetary Fund on a financial safety net for the indebted country is “an urgent task”. Just to rub it in, he went on to declare his total support for the idea of central-bank independence. Government spokesman Andras Giro-Szasz went even further, saying the country was ready to “adjust any law that’s against European Union regulations.”

Yes, Sorry No… OK, Yes Is What I Really Meant To Say

Meanwhile both the EU and the IMF are digging their heals in, and taking a hard line. European Commission President Jose Manuel Barroso has written to the Hungarian prime minister, calling on him to withdraw recent offending legislation since they likely failed to comply with community law and could well prove to be incompatible with the EU Treaty itself. According to a report which appeared on the website Origo.hu, Barroso asked Orban to withdraw the legislation on the central bank as well as a ‘stability law’ proposed earlier this month which would tie the pace of debt reduction to the rate of economic growth. “I would forcefully advise you to withdraw two pieces of cardinal law now in front of parliament,” he is reported as writing in late December. Taking a leaf out of Angela Merkel and Nicolas Sarkozy’s book perhaps, Orban seems to have ignored Barroso’s plea, since the bill went into law on 30 December.

In fact, in what might now turn out to be a classic example of “famous last words” a defiant Viktor(ious) Orban stated after the passage of the bank bill: “It is a European fashion that the central bank must be in a sacred state of independence…Nobody can interfere with Hungarian legislative work, there is no one in the world who might tell the elected deputies of the Hungarian people which act to pass and which not to.”

Only 6 days and a downgrade or two later, the mood is rather different, and Tamas Fellegi told reporters before boarding the plane to Washington that Hungary is open to talks about the central-bank law, indeed there is nothing the country isn’t open to talking about if need be to secure a loan.

Nonetheless both the IMF and the EU will surely continue to play hardball, after all they now have the upper hand. Hence a report which appeared on another Hungarian website (Figyelo) this weekend, which cites a “precautionary” programme that was being prepared for Hungary. The document the website reproduced also suggested the IMF board (which will meet on 18 January to discuss Hungary) was of the opinion that the country could receive a Stand-By Agreement – which carries more conditions than a precautionary agreement.

According to the document summary, the IMF will require Hungary to re-establish the independence of the National Bank of Hungary, strengthen the Fiscal Council, exercise a stricter fiscal policy, reduce and then withdraw crisis taxes, end ad hoc economic policy measures, fully implement agreed reforms, restructure the social welfare system, restructure public transport companies, and introduce a personal bankruptcy law. ,

The report describes Hungary’s political climate as “complicated”, and suggests the chance of Hungary losing its EU Cohesion Fund support because of an excessive deficit procedure that has dragged on for eight years a “real danger”. Should this eventuality materialise Hungary would loose funding equivalent to 2% of GDP.

Short Term Crisis, But Long Term Deep-Seated Issues That Won’t Simply Go Away

Yet whatever the political obstacles, it is very likely that some sort of deal will be patched together. The consequences on both sides of the fence are too large to play with for too long (although remember accidents in history do happen, indeed following one school of thought they are the very motive force of history).

Last weeks downgrade from Fitch (to BB+ aka “junk”) will have concentrated everyone’s minds, since it was one further warning of what would quickly happen if agreement were not reached – the currency would fall through the floor, the debt would become rapidly unsustainable and the country would default, and even continuing membership of the EU would be put in doubt. As in then Greek case, it is doubtful at this point that anyone is ready to walk through this particular door, even if they repeatedly keep getting shown it.

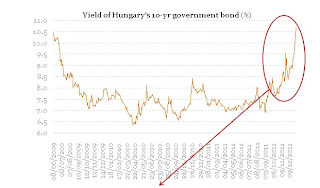

Naturally the financial markets have responded badly to all the brinksmanship and uncertainty, with the forint repeatedly hitting record lows against the euro (the latest was of 324 to the Euro on Thursday), while the yield on 10 yr government bonds has spiked sharply (see chart above from Portfolio Hungary). Following the Fitch decision Hungary’s 5-yr CDS spread leaped by 38 basis points to 754 bps, dragging Poland’s (up 16 bps to 307 bps) and those of the Czech Republic (up 15 bps to 194 bps). Naturally, as in the Greek case, it is the risk of regional contagion which is the biggest headache facing policymakers.

Chronicle Of A Problem Foreseen But Not Dealt With

The danger to the Hungarian CDS has been obvious for some time, since six months ago markets were badly underpricing Hungarian risk. As I said in July:

“And if we move over to Hungary, then we find that as of last Friday CDS stood at around 285, well below the highs of over 400 seen as recently as last November in the wake of the Irish crisis. Arguably the Hungarian case is the most glaring example (of risk underpricing), since it is the East European country with the highest debt to GDP levels (around 80%, of GDP, of which 45% is forex denominated) it has very high gross foreign debt (around 135% of GDP), and it is a country where institutional quality is a constant cause for concern. In many ways Hungary is the Italy of the East. Apart from the presence of a strong trade surplus there is not that much to commend in Hungary’s recent economic performance, yet its CDS has fallen into line with a regional pattern, and there is little in the way of what is happening in Spain and Italy to be seen in the spread, let alone what is going on in Slovenia and Slovakia”.

Obviously market sentiment has changed, and the question now is whether markets are overreacting. In the short term they may be, since although the danger of falling into a default spiral is real, there is the also a genuine possibility (but not certainty) of a deal being reached. But in the longer run they are not, since what Hungary is not suffering from is a short term liquidity crisis (or even a balance of payments one, the current account is in surplus), but a long run solvency and social sustainability one.

But to get to see what the end of this story may be, we need to go back to the beginning, and the origins of the present Hungarian crisis in the market correction of 2006. Those who could see that the global imbalances which were developing would eventually unwind couldn’t fail to see the warning signs that year, as Iceland, Turkey and Hungary all wobbled under the force of those early seismic tremors. That was when I got interested in Hungary, and took the decision to set up a dedicated blog for the country.

Hungary seemed interesting for a number of reasons. It was a harbinger for many of the things which were to come, the rapid expansion of a fiscal deficit following the ending of a credit driven consumer boom (think Spain or the UK today), the ageing and declining population phenomenon in Eastern Europe, and it became the test pad for the application of “confidence building” measures, austerity programmes and structural reform to the economy of a country which had severely lost competitiveness.

Nearly six years later, and with the Hungarian economy on the brink of a possible default, perhaps it is now a good time to take stock of whether this approach has worked.

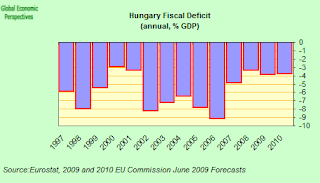

The 2006 Fiscal Deficit

The key to getting inside the Hungarian problem is to ask yourself the simple question why the country had such a whopping fiscal deficit (over 9% of GDP) in 2006. For the popular press the answer was easy, it was the result of a spendthrift government trying to buy votes. In fact the then Prime Minister Ferenc Gyurcsany made it easy for them, he inadvertently admitted what they had been up to:

Some came who did not bother whether they would have a place in the country’s government, because they understood that this bloody country is about something else. They can understood that it could be worth being a politician here at the beginning of the 21st Century because we can create a different world……Instead, we lied morning, noon and night. I do not want to carry on with this.

While this answer may well satisfy journalists and political sociologists, it cannot be entirely satisfactory for economists, who realise there are underlying processes (beyond flawed and corrupt individuals) behind these phenomena and want to get tot he heart of them. Could it be, for example, that the 2006 deficit was the culmination rather than the start of something. Certainly there had already been large deficits from 2002 onwards.

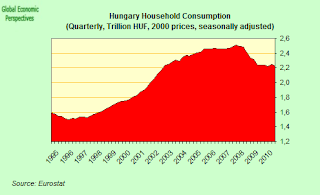

I’ve looked at a number of examples now of where fiscal “extravagance” suddenly breaks out in a country – Portugal in the late 1990s, Spain more recently – and a common pattern I note is that government deficits often surge at the end of a consumption boom as politicians try to keep economic growth humming and living standards rising, even while revenue falls. To some extent this does seem to have been Hungary’s case. As can be seen in the chart below, the country did have a very large consumption driven boom between 1999 and 2002.

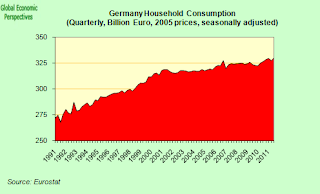

After 2002 the thing evidently eased off, meaning government revenue slowed, and hence the start of the deficit problems. Why the consumption boom ended is not clear, but it does form part of a pattern. Although conventional economic theory doesn’t seem able to account for the phenomenon, many countries seem do seem to pass through some sort of transition whereby they move from been consumer driven to export driven economies. Germany is a good case in point, since as we can see Germany had a substantial consumer boom in the 1990s before converting itself into the export champion we have now grown to know and love.

Competitiveness Loss Which Precedes Fiscal Lunacy

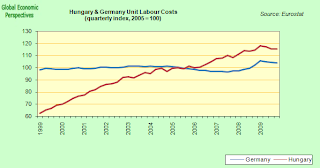

The big difference between the German and Hungarian economies though, is in the extent to which they lost competitiveness during the boom years, and in the extent to which the government tried to use deficit spending to sweep the problem under the carpet. The chart below shows a comparison of movement in unit labour costs between the two countries over the relevant period. Now it is important to realise that unit labour costs are not about “catch up” improvements in living standards, they simply tell you how productive your workers are for each hour worked (or the cost in labour terms of each euro of GDP), and as we can see, while Germany held costs almost constant, Hungary let them rip. Which simply means that once you can no longer rely on consumer borrowing or spending for headline growth in GDP, you can’t fall back on exports, because your economy isn’t competitive enough, which is the issue all along the EU periphery, although Europe’s leaders are mainly in denial on the issue, simply following the fiscal paper chase without digging any deeper to try to get at what might be at the root of the problem.

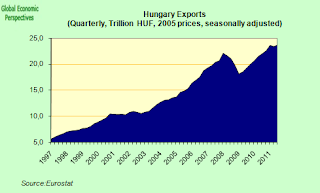

Now the interesting point is that Hungarian exports have in fact risen substantially over the years.

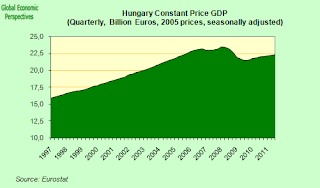

But impressive as all this looks, it has not been enough to get the kind of GDP growth that Hungary evidently needs (among other things to pay its debts and its contingent liabilities to its elderly population).

In fact, despite the massive increase in exports since the end of the global financial crisis, Hungarian GDP has only recovered slowly. Hungary’s economy fell by 7% in 2009, grew 1% in 2010, and is heading back into recession at the end of 2011. Even leaving out the crisis year of 2009 Hungary has only managed average growth of under 1% since the austerity measures began in 2006. Something, somewhere evidently isn’t working as it should. In addition to the ongoing programme of structural reforms what Hungary needs is a short sharp shock in the form of forint depreciation, to recover a large chunk of competitiveness and boost investment into the export sector. In this sense “competitiveness” means having an export sector which is large enough (as in Germany) to drive GDP growth forward. At present value added in Hungarian manufacturing is only just over 20% of GDP as compared with over 40% in the German case (the gross export values are misleading, since Hungarian industry is highly integrated with German industry, and a lot of the activity is processing components which are imported and then re-exported).

But this kind of forint depreciation (which to some extent we are seeing now under the impact of the crisis) is impossible to achieve without debt restructuring (or outright default) since so much Hungarian debt is denominated in other currencies (largely Swiss Franc – roughly 85% of Hungarian domestic mortgages are denominated in CHF). Gross external debt is around 140% of GDP and rising as the forint falls, while government debt stood at 83% of GDP at the end of September, and around 45% of this is forex denominated.

No-Devaluation High-Interest-Rate Trap?

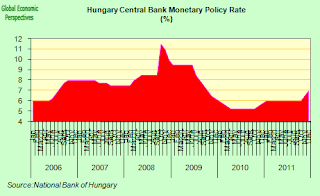

So far from wishing for the forint to fall, the central bank is busily raising interest rates to try to sustain its value. Base rates have now been increased twice since October, and now stand at 7%, even though the country is heading towards recession and most central banks are near the zero bound.

Naturally, raising interest rates only helps choke off declining domestic demand even further.

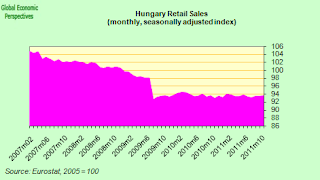

Incidentally, the sharp drop in Hungarian retail sales that can be seen in July 2009 is the product of a 5% rise in VAT, a rise from which Hungarian sales have never really recovered. So much for the received folk wisdom that consumption tax hikes are “comparatively harmless”, since the real situation is “it depends”.

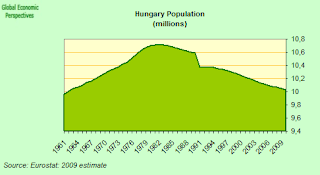

Naturally, this export dependence is not simply anecdotal. Hungary, like many of its Central and Eastern European peers, has a massive demographic problem. Population is already falling, and any sudden default would only precipitate the added issue of a sharp surge in the numbers of qualified young people packing their bags and leaving.

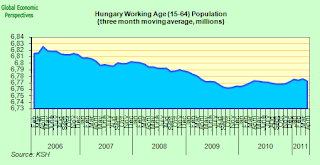

And the potential labour force is both ageing and shrinking.

So the problem isn’t going to go away, and is only set to get worse with time.

The Harbinger Of Things To Come On The Periphery?

Thus Hungary is in a similar situation to many countries on Europe’s periphery (in or out of the Euro), without real devaluation the economy will never get enough growth traction, and restructuring of the debt at some stage or another is more or less inevitable.

But there is another factor which gives what is happening now in Hungary special significance, and that is the problem of “reform weariness”.

Basically, if the solutions which are being promoted by the IMF and the EU Commission are based on a faulty or incomplete analysis of the situation, then the measures being promoted eventually won’t work as they should, and this will lead to disappointment. The political dynamics of what then happens is what should be concerning those who are able to think about such things. Could Hungary be the first example of a country that has lost hope and gone down the road of believing in demagogic politicians? Will there be more Hungaries? Could this be what the future in countries like Greece, Latvia, Portugal and Italy will look like. And if it is, how the hell do you hold the EU, let alone the Euro together? This is the burden of responsibility that now falls on the shoulders of those with responsibility for taking the decisions.

It was, after all, in Hungary that the new orthodoxy of relying on “non-Keynesian” effects related to expectations and credibility was formally announced and put to work.

In emerging market countries with debt overhangs, the “Keynesian” effect of fiscal adjustment is likely to be outweighed by “non-Keynesian” effects related to expectations and credibility. Non- Keynesian effects have to do with the offsetting response of private saving to policy-related changes in public saving. In particular, if fiscal adjustment credibly signals improved public sector solvency, a fiscal contraction could turn out to be expansionary, as private consumption rises based on the view that future tax hikes will be smaller than previously envisaged. IMF – Hungary, Request for Stand-By Arrangement, November 4, 2008

Naturally this approach was subsequently transferred from emerging market countries (like Hungary) to more developed economies along Europe’s southern fringe. Private consumption, unfortunately, has notably failed to rise. Perhaps there will be more than a little historic irony involved in Hungary being the country where the whole experiment eventually went badly wrong, although I doubt the Hungarians themselves will se it that way.

Back at school I remember learning about the example set by the British army sergeant at Vimy Ridge who lead his troops out of the trenches and into the withering fire of the German machine guns with the phrase “Come on You Bastards, Do You Want To Live For Ever!” This was the classic example, it seems, of charismatic leadership. Only years later did I twig the double entendre of the expression (which could also have been, “Come on You Bastards, Don’t You Want To Live For Ever!”

So this weekend, as he tosses the coin to decide whether to accept the EU conditions or not, Viktor (she loves me, she loves me not, she loves me….) Orban may do well to pass an idle moment or two perusing the immortal lines left for our greater edification by the late, great and one-and-only Eddie Cochrane.

Now there are three steps to heaven

Just listen and you will plainly see

And as life travels on

And things do go wrong

Just follow Steps 1, 2 and 3

Comments are closed.