Can Obama cut the deficit and have job growth too?

By Stephanie Kelton

White House Press Secretary Jay Carney recently explained President Obama’s “singular concern, which is that the outcome of the deficit reduction talks produce a result that significantly reduces the deficit while doing no damage to the economic recovery and no damage to our progress in creating jobs.”

White House Press Secretary Jay Carney recently explained President Obama’s “singular concern, which is that the outcome of the deficit reduction talks produce a result that significantly reduces the deficit while doing no damage to the economic recovery and no damage to our progress in creating jobs.”

Great. And I want to go on a donut diet and shed ten pounds.

As far as Washington is concerned, there are only two ways to bring down the deficit: cut spending or increase taxes. Both reduce private sector incomes. This means that the president is looking for a way to reduce private sector incomes without hampering sales or job creation.

Can it be done? Let’s see.

Suppose the government decides to cut spending by $100. This means that someone in the private sector is receiving $100 less than they were getting before the government tightened its belt. Ordinarily, we would expect this to generate an even bigger drop in GDP, as the decline in income leads to multiple rounds of contraction due to the effect of the multiplier.

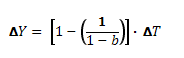

For those that need a refresher, the multiplier is given by (1/1-b), where b = the marginal propensity to consume (MPC) or:

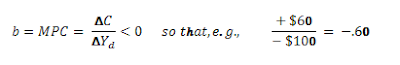

It shows the relationship between disposable income (Yd) and household consumption spending (C). As disposable income increases, we expect household spending to rise, making the value of the MPC > 0. But we also expect people to save a bit more, so the MPC < 1.

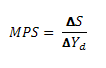

This means that we also have a marginal propensity to save, which is given by:

The MPS shows how saving changes in response to a change in disposable income. Like the MPC, the MPS is expected to be greater than zero but less than one. And, since you can only do one of two things with your disposable income – spend or save – the MPC and the MPS must always sum to 1. This is all basic Econ 101.

So let’s suppose that the MPC = b = .90, which means that people tend to spend, on average, $0.90 out of each additional $1.00 of income they receive. The other $0.10 is added to their savings. Now suppose that the government reduces its spending by $100. What will happen to economic activity as measured by output (Y) ?

After multiple rounds of spending reductions (the multiplier at work), output falls by $1,000. Ouch!

But the president is looking for ways to reduce the deficit without damaging the recovery or destroying jobs. So maybe a tax increase is the way to go. Let’s check.

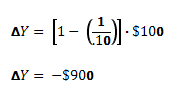

A tax increase means less disposable income , and this means less spending by consumers. As before, a reduction in spending by one party (in this case the private sector) will result in several rounds of additional cuts, because of the multiplier effect. We can use the following equation to measure the macroeconomic effect of a change in taxes.

The large bracketed term is the tax multiplier, and it is used to demonstrate the macroeconomic effects of an increase/decrease in taxes. Since the president is trying to reduce the deficit, we should consider the effect of a $100 increase in taxes. If the MPC = b = .90 as before, we get:

In this example, output falls by $900, better than the previous outcome, but still not what Obama is looking for. So the challenge remains: How can the government reduce the deficit without negatively impacting economic activity?

As Warren Mosler pointed out, it would require Congress to tax where there is a negative propensity to spend and cut where there is a negative propensity to save.

What does this mean? A negative propensity to spend means that people would spend more if the government raised taxes and reduced their incomes:

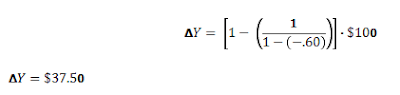

Under these circumstances, the economy would benefit from, say, a $100 tax increase, because households would spend more even though their incomes were falling:

Similarly, if the government cuts spending where there is a negative propensity to save, then output and employment will increase even as the government tightens its belt.

But a negative propensity to save means that the MPC >1 because the MPS < 0 and they must sum to 1:

Under these conditions, a $100 cut in government spending results in:

But what are the chances of this happening in the real world? Probably zero. Spending cuts and tax increases reduce private sector incomes. And the private sector isn’t going to celebrate the loss of income by going on a shopping spree.

The bottom line is this: As long as unemployment remains high, the deficit will remain high. So instead of dreaming about ways to pull off the impossible, it’s time get to work on a plan to increase employment.

Here’s the formula: Spending creates income. Income creates sales. Sales create jobs.

If you think you can cut the deficit without destroying jobs, dream on.

This article first appeared at New Economic Perspectives.

what a powerful piece

you forgot the easiest way to cut the deficit! encourage another gigantic bubble and continue letting all the big banks commit fraud! that’ll reduce the deficit and create jobs! what could go wrong?!?!

Here’s a couple of alternatives…

1) Tariffs. While particularly unpopular and certainly impacts the globalization path. This solution will reduce the current account deficit and likely also produce new infrastructure spending at home (i.e jobs).

2) A wealth tax. Taxing current income has adverse impacts on current investment. However, taxing wealth (especially a one-time only tax) could be used to reduce the deficit and also create the correct incentives by government (and their influencers) to reduce spending in an intelligent way.

The Keynesians cannot see beyond the short-term. If we do not consider long-term structural solutions, then any kind of additional stimulus will only go further to seal our fate.

I think it’s simple (though politically not easy).

1) Introduce a (if possible bipartisan) law that that increase the gas tax by at least $ 0,05 (or a percentage that gives similar results) every year for the next 30 years.

2) Introduce bonds secured by the (first 10 years of the) tax / fee / whatever you call it to make it constitutional.

3) Out of the receipts of the bonds, give $ 500 (tax deduction unless out of work) NOW to every owner of a car that is currently registered to offset the worst consequences for people who can barely afford the gas. Maybe later also a tax deduction for every newly registered car that gets a lot of miles / gallon (or for e-bikes?).

4) Use the proceeds of the bonds and the later tax receipts to

– repair existing infrastructure

– upgrade (i.e. electrify) cross-continent railroads

– build HSR along the coasts and in other selected spots

Good for jobs, good for infrastructure, good for the economy, good for the environment … Bad for people who love gas guzzlers …

There’s a blended solution here Edward. We needed a much targeted Keynesian solution. I believe the stimulus worked to a degree however leaders did not fully interpret the type of recession we were in and the burn rate of the dollars centered mostly on the financial system and no real solutions for structural issues. I must say your blog has become one of my favorites

Thanks for the comments Richard! You’re right that the prescriptions from the Obama Administration were muddled. The reason is that they are taking a cyclical approach to a secular problem. The problem is not a lack of spending per se, but rather too much debt. In past cyclical downturns, the debt problem could be addressed by lowering interest rates and adding in some fiscal stimulus via tax cuts or automatic stabilizers. This time however, rates are at zero percent, the debt overhang is even larger, and the housing crisis makes that a real impediment to growth. Until the housing crisis is dealt with properly, there isn’t going to be a positive resolution via stimulus.

I’m no economist, but if we cut government spending or increases taxes to balance the budget, then people will have less money to spend and job growth will indeed suffer unless other policy changes are made. Fortunately, there are obvious ways to mitigate some or all of this effect.

The first, as mentioned above, is to tax foreign goods like oil, so it’s the Arab Sheikhs who have fewer dollars to spend. My personal favorite solution is to tax oil and spend the money on healthcare. That’s a match made in heaven- every politician can vote for it. Let OPEC pay for granny’s new hip.

The second is to encourage investment by reducing the onorous regulation our government places on nearly all economic activity. Drilling for oil in about three square miles of ANWAR would lead to trillions of dollars of economic benefit for our country. Let’s get on with it.

The third is to provide a stable, attractive long-term investment climate, to increase econonomic activity. This in combination with our balanced budget would spur investment and also bring down long-term interest rates. Short term interest rates in treasuries are low, but the effective rate for years 7-10 is about 5%.

These are simple obvious steps, but our President has been doing the exact opposite. Let’s hope he starts to understand how the economy works.

“Suppose the government decides to cut spending by $100. This means that someone in the private sector is receiving $100 less than they were getting before the government tightened its belt”

In reality, the $100 that government spends is confiscated from someone who would spend it or invest it, in any case.

Your multipliers have it wrong.

thats alot of theoretical bullshit for one article

Stephanie Kelton claims the deficit cannot be reduced without destroying jobs. I disagree, and for the following reasons. (I.e. to use Stephanie’s phraseology, I wish to “dream on” :) )

As Keynes, Milton Friedman, Warren Mosler and numerous other economists have long pointed out, a deficit can be funded either by new i.e. “printed” money or by borrowed money.

Where a deficit is funded by borrowing, there is always a finite crowding out effect. Economists disagree as to how big this effect is, and I don’t claim to know the answer. But to the extent that the effect exists, the deficit is ineffective in creating jobs.

Thus reducing the deficit without affecting total numbers employed is easy in principle: just fund the deficit with new money rather than borrowed money. And to the extent that a deficit funded by borrowed money is ineffective because of crowding out, one gets a bigger bang per buck from the “new money” option. Ergo, to that extent the deficit can be reduced when swapping to the new money option, WITHOUT any job destroying effect in consequence.

Incidentally, since QE involves printing money and buying governemnt bonds, one of the effects of QE will to some extent have been to obtain the above improved bang per buck.

Moreover, what lies behind everyone’s nail biting, neurotic concerns about the deficit? It’s the ever expanding debt that comes in its wake. And when swapping to the “new money” option, the deficit accumulates as monetary base instead of debt. Granted the monetary base and government debt are not much different in nature, but at least reducing the “debt” (with all the negative overtones of that word) might keep some simple folk happy.

Also, what in God’s name is the point in the US government obtaining dollars by borrowing them from China (and paying interest for the privilege), when the US govt has its own printing press where it can produce dollars at no cost? Anyone know? Does spending $X from the printing press have any bigger inflationary effect than spending $X borrowed from China? I don’t think so.