Turkey Rate Cut Very Negative For Turkish Lira, Further Losses Likely

As we feared, Turkey central bank cut rates by 50 bp to 6.5%. Before the recent comments by Deputy Governor Basci, the bank was saying that rates were headed higher towards the end of next year. Latest central bank survey shows market was looking for 50 bp of tightening over the next 12 months, so the abrupt shift to the possibility of rate cuts took the markets by surprise and calls into question the bank’s credibility. The attempt to fine tune policy with a combination of policy rate cuts and reserve requirement hikes is a clumsy one. As we wrote earlier about Brazil, reserve requirement hikes and policy rate hikes are a complement. From what we’ve seen historically in EM tightening cycles, reserve requirement hikes are often the first step in the cycle and are later followed up with policy rate hikes. Moving these rates in opposite directions strikes us as misguided and definitely unorthodox.

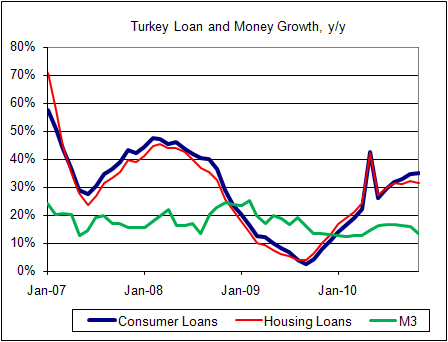

We view the Turkish economy as being in good shape and not in need of further easing. GDP rose 5.5% y/y in Q3, slower than 10.2% y/y in Q2 and 11.8% y/y in Q1 but still quite strong. Inflation eased to 7.3% y/y in November from 8.6% y/y in October. The inflation targets for 2010, 2011, and 2012 are 6.5% 5.5%, and 5.0%, respectively and so while inflation is slowing, the targets are ambitious and rate cuts just do not seem warranted right now. Consumer loans are growing close to 35% y/y, adding to what see as growing demand pull inflation risks. The surging current account gap comes in large part to strong growth and import demand, and so cutting the policy rate risks exacerbating this problem. After the November meeting, the central bank warned that capital inflows “pose a risk to the current account balance and financial stability.” October current account gap was -$3.7 bln, bringing the 12-month total to -$40.6 bln and the gap is very likely to exceed 6% of GDP in 2010 and perhaps near 8% in 2011. Meanwhile, FDI continues to slow and so the 12-month total of $6.7 bln only covers about 16% of the current account gap. This is down from around 70-75% coverage back in 2009, so Turkey’s concern about hot money flows comes at a time when the country actually needs those flows to finance the current account deficit.

We have been bullish on TRY this past year, but we are moving to a more negative stance given the policy shifts and the resulting shift lower in interest rate expectations. Add in the surging current account gap (likely to move even higher next year) as well as some political risks ahead of the 2011 general election, and we get a picture of TRY underperformance going forward. This would continue recent trends, as TRY has been the third-worst EM performer vs. both USD and EUR so far in Q4. For USD/TRY, 1.5280 area is very important and represents the 62% retracement of the June-November drop. This level was tested today and held, but we see an eventual break that targets the June high around 1.6150.

Comments are closed.