Not South Florida but Condo Problems in Raleigh, NC Too

by John Lounsbury

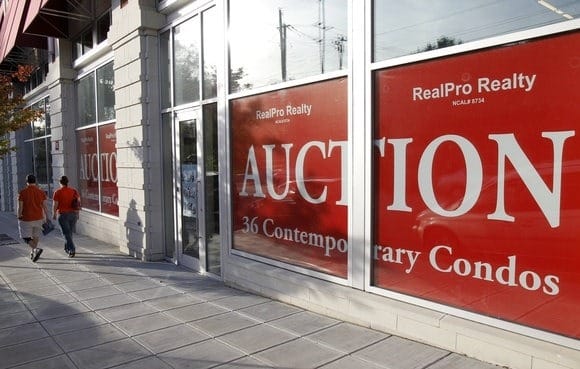

It may not be South Florida, but there are condo problems in Raleigh, NC too. Sunday 32 condo units were auctioned off at an average price of $210 per square foot in the West condo unit in a downtown entertainment district known as Glenwood South.

When the West condo building was finished in 2008 a total of 80 units had been sold at an average cost of $300 a square foot, about 40% more than buyers paid Sunday. The original sales brought in about $28 million and the auction Sunday another 8 million, so presumably only $9 million remains on the original Wells Fargo (WFC) loan of $45 million on the project. Wells Fargo has not foreclosed on the property and West’s developers are still in possession, according to an article by David Bracken in the Raleigh News & Observer.

With 68 units remaining for sale, the developers will presumably still come out of this venture in one piece. If the remaining 68 units have the same average value of the 32 properties auctioned Sunday, the sales proceeds for the remaining units, at the same valuation as the auction, would bring in about $17 million. The developers have announced that they will be placing the remaining units on the market at prices higher than the auction produced.

Another condo project in downtown Raleigh, Hue, never sold a single unit and was seized through foreclosure by the lender earlier this year. It’s 208 units have been converted to apartments.

The Raleigh experience is not that much different from the very distressed South Florida situation. (see article in Real Estate Channel).

I lived in RTP when units in this building were selling at 300k+ pre-construction. The salespeople were raging bulls on Raleigh real estate, but wouldn’t even listen to argument the area was being developed at a blistering pace.

When Martha Stewart decides to build homes in the area… you knew the market is getting top heavy.

@Matt_SF wasn’t NC one of the last states to correct when the US housing market went south? For a long time, Charlotte seemed immune to the troubles you saw in Florida or California.

Yes. I remember reading a WSJ article talking about KC and Charlotte as the last of the unaffected cities. Condo builders chased opportunity in CA, FL, NV first. Then moved to places like Raleigh and Charlotte without any precedent for condo premiums.

When Trump put a site on the southern edge of Uptown Charlotte under control, I knew we were only months away from joining the rest of the country. We eventually did.

Sev.

I believe so yes. The Raleigh area, or Research Triangle Park (RTP) as we call it, has seen 2 bubbles in the last decade. The big one in 2007 to present, but also a smaller one during the tech boom and bust. Companies like Nortel, Cisco, IBM, and dozens of others, setup massive 5,000+ employee campuses in no time flat. When the Nasdaq sold off, home prices dipped.

Cheap credit restored the market in 2003-ish, but once the recession hit in 2008 and layoffs began in 2009, plus being massively overbuilt (like Florida), Wake and Durham counties were hit hard.

I’m not as up-to-date on the Charlotte market as I used to be, but Charlotte is a finance industry heavy market (believe they rank #2 in U.S. only to New York). The TBTF bailouts probably helped stabilize local real estate considering Bank of America is headquartered there.