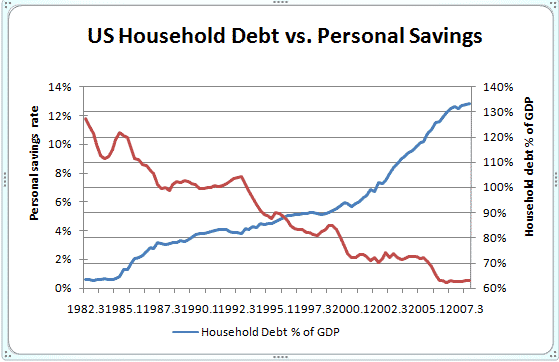

One reason many pundits feel this particular downturn will be quite nasty is the level of debt consumers have versus their savings. Since July 1982, when the stock market bottomed, Americans have been dis-saving and leveraging up like nobody’s business.

Since Alan Greenspan became Federal Reserve Chairman in 1987, the Federal Reserve has always supplied easy money when the economy hit the skids. As a result, Americans were never forced to retrench by reducing debt and rebuilding savings in anticipation of economic upswings. The result has been an ever increasing debt load and a low savings rate not seen since the Great Depression.

If you remember my separate charts of the day on savings and on household debt, you’ll know that Americans have never been so indebted and have never saved so little since record-keeping began after World War II.

However, looking at these two factors together on the same chart really fixes the mind on the magnitude of the problem.

Source

National Income and Product Accounts, U.S. Bureau of Economic Analysis

Great post. I think that is why the markets have a lot farther to fall. The economy is 71% consumer related. If the consumer doesn’t have any more savings and can’t get more credit-revenues will fall-stocks will fall.