Why my base case for 2020 is recession

Back at the end of July, I was talking about my macro thesis. And I led off writing this:

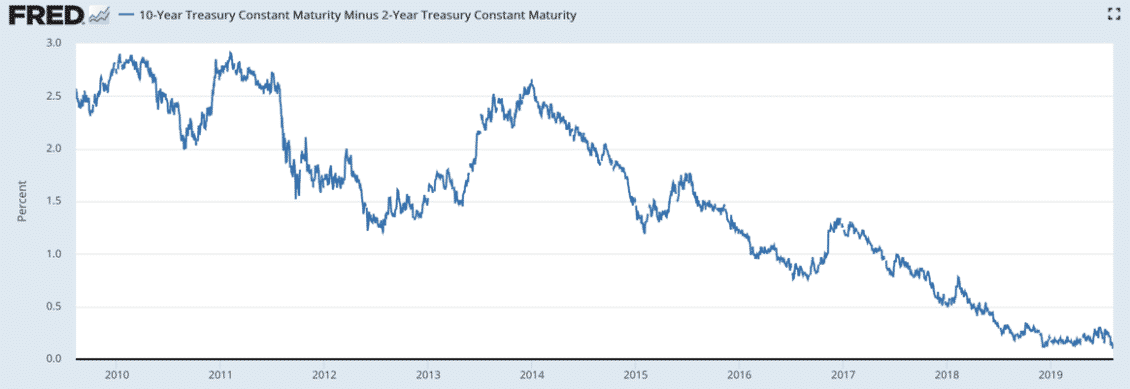

The US is the laggard in this slowing but is affected as well. From a markets perspective, that means a convergence to zero, with yield curves flattening as nominal growth rates contract.

I didn’t mention the word recession of course. That’s because we’re not there yet, though I think we should be by the end of 2020. But, that’s a speculative call at this point. The near-term outlook doesn’t have a recession in it, at least for the US.

That’s my glass half full way of saying we can avoid recession in 2020 if policy makers make the right moves in time to prevent further slowing. But, clearly, if I have recession for 2020 as a base case, I don’t think policy makers will make the right moves in time. So let me flesh out my speculative call here.

Indicators

In the past, I have talked about the inverted yield curve as more of an indicator of overtightening rather than a predictor of recession. That’s because what an inverted yield curve shows is that US government bond market participants are willing to accept a lower yield for longer duration assets, something consistent with an understanding that future base rates will be declining over the medium term. So what the inversion suggests is that monetary policy is too tight and present rates are too high relative to what we will see going forward.

If we had a mid-cycle slowdown like the one we saw in 1994, we would expect this inversion – or close to it. And that’s what we saw.

The curve didn’t invert. But it came darn close to inverting. Notice, though, that the curve did invert in 2000 before the recession in 2001.

So, why use the 2-10 year spread and not the 3 month-10 year spread that the NY Fed uses?

Personally, I prefer to look at the 2-10 right now because it is a gauge of front-end inversion lengthening. For example, the curve is now completely inverted out to 5 years instead of three. That’s a signpost for a potentially longer rate cut cycle not consistent with a mid-cycle slowdown.

So, the 2-10 spread is a better proxy for the shape of a curve indicative of recession at this point because the curve is now inverting from overnight outwards. Therefore, I prefer to look at the 2-10 because it is a gauge of front-end inversion lengthening.

The complete inversion out to 5 years instead of three has only just occurred. That’s a signpost for a potentially longer rate cut cycle not consistent with a mid-cycle slowdown.

What can policymakers do

The US is the outlier here because the slowdown is more pronounced elsewhere. But, it doesn’t mean the US is immune. Now, it is incumbent on policymakers to recognize the recession threat that is all around us.

Congress has passed a spending bill that shows more spending and higher deficits for the next two years. It’s not explicitly geared toward fighting a potential recession, but it can help do that.

But the Fed needs to wake up. Powell has been sending very mixed signals. After his July press conference he almost sounded like he wanted to forego any future rate cuts for fear of further dissents, after getting two in July. I think that would be a mistake. It would signal to the market that the Fed was behind the curve, long bonds would rally and the 2-10 would invert.

The 2-10 is actually only 5 basis points away from inversion right now.

Why I see recession coming

I don’t think the Fed fully appreciates this. Just as in 2006, Bernanke was explaining away reasons for poo-poohing the curve inversion, I think this Fed doesn’t see a threat. But the threat is real. And it will increase if the Fed doesn’t react in a way that shows it appreciates this. Investor sentiment will tank and financial conditions will tighten without the Fed having to raise rates. The strong dollar crushing foreign US dollar debtors is a major reason why.

In the meantime, expect the trade war, which is now a currency war, to worsen. The Yuan fixing has weakened the Chinese currency every day since August 5th.

Yuan fixings

Aug 5 6.9225 +0.0229

Aug 6 6.9683 +0.0458

Aug 7 6.9996 +0.0313

Aug 8 7.0039 +0.0043

Aug 9 7.0136 +0.0097

Aug 12 7.0211 +0.0075— Edward Harrison (@edwardnh) August 12, 2019

And that continued into today, with the Yuan fixing at 7.0326. Trump won’t sit by and watch this without a response. At some point, he will come up with something. And the Chinese will likely retaliate. My fear is this turns into something worse – a cold or hot war, something Alexandra Scaggs has entertained over at Barron’s.

So, by the end of 2020, I expect the accumulation of policy errors by the Fed, the eurozone, the Trump administration and others to combine with an already slowing global economy to push even the US into recession. Germany is likely already there. The same goes for the UK. The same is true for Asian countries like Singapore, given recent data. The US is not immune.

That’s my base case.

Watch to see if the US Treasury curve fully inverts out to seven years. That’s next on the horizon. That’s when I think we reach a point of no return.

Comments are closed.