Very negative market signals

The economic data out of the US and elsewhere still point to continued economic expansion over the near term. But, what we’re seeing in financial markets right now suggests markets are discounting serious economic problems down the line. So, let me go through the news flow and comment on what I’m seeing.

Sell in May and Go Away

Think about the market mood over the last couple of months, before Trump put tariffs on China. We had massively unprofitable companies like Lyft and Uber going public at huge valuations. Unknown unicorns like Beyond Meat went public too. Elon Musk raised billions of dollars for Tesla, days after a quarterly earnings conference call in which he said he didn’t need the money. Equity markets went to new record highs, recovering all of the losses from December. Everything was bullish.

But, this has all fallen apart now. As I write this, futures are showing another 200 or 300 point loss for the Dow at the open. And yet, there hasn’t been any major break in the data flow. Yes, Q2 GDP trackers are showing growth slowing. But that was well-anticipated by markets. The same goes for earnings growth. Nothing in earnings is deteriorating any faster than anticipated – just the opposite.

To me, the market’s reaction to the trade standoff between the US and China seems more of a catalyst for profit-taking than a reaction to an economically existential change.

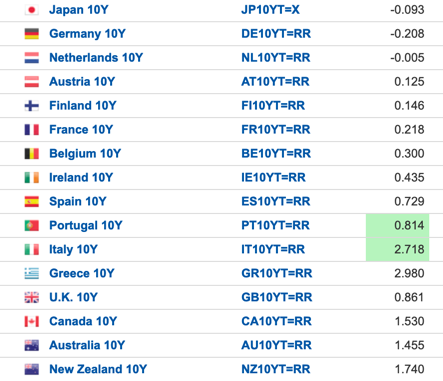

The Netherlands is negative yielding

But when you look at bonds, you see something a lot more ominous.

Source: Investing.com

Yesterday, I noted the Dutch 10-year yield went negative, joining the Germans, where yields are negative 20 basis points. This isn’t just a liquidity-led rally in German bunds then. It is a true flight to safety due to concerns about global economic growth. And so, that dovetails with what we are seeing in the US, where the worry is trade with China and Trump’s tariffs on Mexico over Central American migrants.

And again, this is not because European data is deteriorating rapidly. I think it’s because we are seeing the global world order breaking down in the way I have posited in my last two posts about the collapse of the center, with Donald Trump leading the charge.

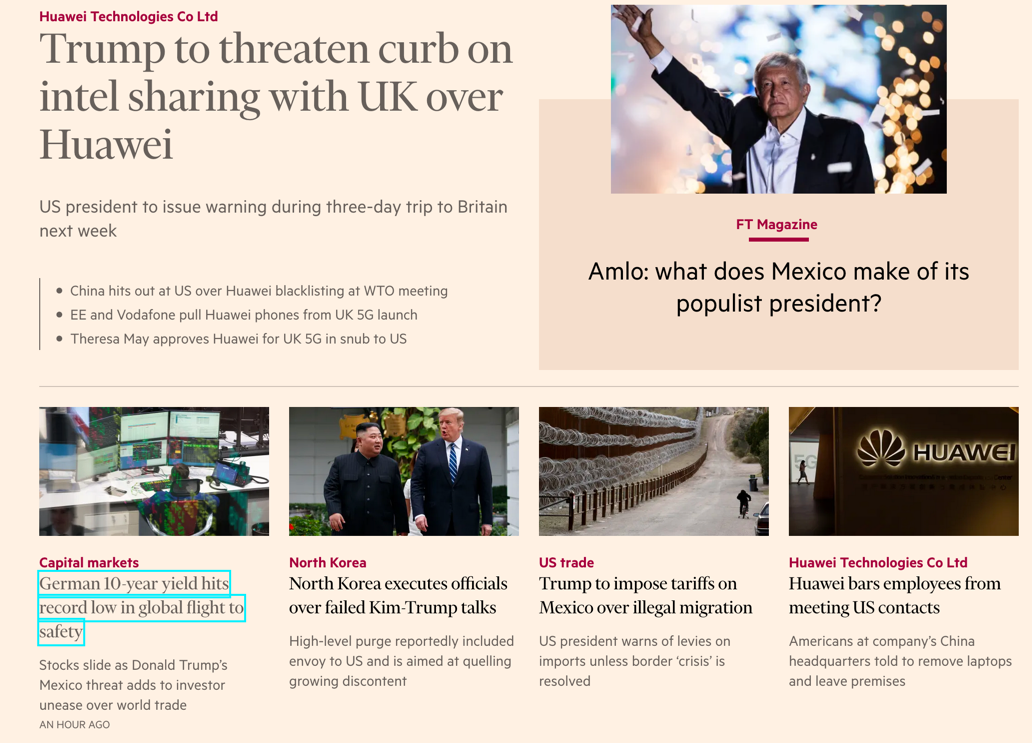

Look at the headlines in the Financial Times, for instance

It’s all about the atomization of the globalized world order, with various factions retreating to their national or regional foxhole. The North Korea headline tells you that there are also military implications to this, since that stand-off is over North Korea’s military weapons.

US curve inversion of over 40 basis points

I think we should be very alarmed at what the markets are telling us. In the US, most people are focusing on the curve inversion, with 3- and 6-month yields higher than 10-year yields. But look at the belly of the curve.

It’s the inversion between 6-months and 3 years that are creating the problem. It’s now just over 40 points. That’s not a small inversion, folks. It’s huge. It’s gargantuan. This is a flashing red sign of risk-off. It’s telling you that markets are expecting the Fed to cut aggressively later this year and next year or recession will take hold. Perhaps recession would take hold anyway.

So, that’s the signal I am looking at. And the question becomes what the Fed does in response. In December, we saw the Fed back off as equity and stock markets moved as they are moving today. But back then, the inversion was less than it is today. Today, the yield curve is screaming for the Fed to cut. And I don’t think the Fed will cut for at least another 4 months. The first cut is in September in my view. And even that should be in doubt because there is no economic data on which to base that cut. How does the Fed justify a rate cut when the economic data have yet to show economic deterioration?

So we are in big trouble here.

China and Mexico tariffs

Now, on the proximate cause of the latest bout of volatility, it’s tariffs. This trade war between the US and China will escalate. Look at what people in the know in China are saying:

The U.S. approach to trade talks has been “bullying and America First”, whereas the principles of China’s approach to negotiations were equality and cooperation, said Dai Xianglong, who headed the People’s Bank of China from 1995-2002 and remains an influential figure in China.

“It’s hard to reconcile these,” Dai told a seminar on U.S.-Sino trade relations, noting that trade friction between China and the United States was a long-term issue.

[…]

“I expect that at next month’s meeting of the leaders in Japan it will be difficult to achieve major progress,” Dai said, later adding that he was not confirming that the meeting would take place, but he hoped it would.

Expect no progress and Chinese retaliation in one form or another, likely the currency. You know the Treasury selling retaliation tack makes no sense. China cannot weaponize its US Treasury bonds. The talk of rare earths retaliation is overblown. But, just recently, the US Treasury Department decided not to label the Chinese currency manipulators. And so, now is a perfect opportunity for a currency retaliation. That’s where I see the trade war going.

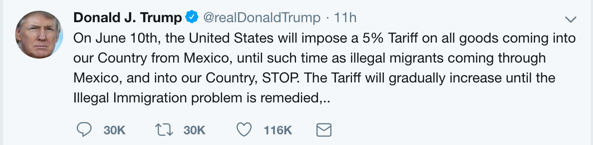

But now there is the Mexico situation.

Think of the migrant flow from Central America as akin to the migrant flow from Syria into Europe, with Mexico in the role of Greece and the Balkan countries and the US in the role of Germany. The migrants want to make it to the safe, rich country. And they are willing to traverse through the less wealthy countries to do so.

That migrant flow is not going away until the root causes in the source countries in Central America are solved. Tariffs aren’t the way to solve this problem, of course. And so, it highlights how Trump is crystallizing the mood of confrontation that is simmering beneath the surface as the center collapses globally.

That’s the risk here. And at the margin, when the global economy is slowing, it creates serious economic risk over the medium term. This is what markets are reacting to. I think the genie is out of the bottle though. It will be very difficult to walk all of this back for Trump. He has multiple fronts of simultaneous confrontation: China, Mexico, North Korea and Europe (where tariffs are still being threatened). Add the UK to the list due to the Huawei threat highlighted above in the FT’s headline. One of these situations is destined to blow up. So, Trump is creating chaos as he tears up the global world order. And markets are reacting to this.

No-Deal Brexit likelihood increases

The Conservative Party in Britain suffered greatly during the recent round of European elections. The consequence of Theresa May’s shambolic leadership is an implosion of support for the party. And the lesson the party seems to have learned is that it needs to install a hardcore Brexiteer as Prime Minister, with a no-deal Brexit as a likely outcome. Boris Johnson, who engenders zero trust on the continent is a leading contender to succeed Theresa May.

So, I believe we could see a no-deal Brexit here, as a result. That would a very negative outcome in the midst of these other global uncertainties. And it only adds to the sense that the global situation is fragmenting. This is negative for stocks and bullish for government bonds everywhere in Europe, particularly in the UK.

Conclusions

So, the hard economic data may not be telling a story of impending doom. At worst, it’s telling the story of a mild slowdown at present. But the volatility in the political economy is huge. And markets are reacting quite negatively. The market signal that worries me most is the 40 basis point inversion between 6 months and three years on the US Treasury curve. It is screaming recession risk in the next ear to 18 months.

I think one of these global political economy risks will crystallize in the next year. And it will do so at a period of global vulnerability. Let’s see how resilient the economy is when we go there.

Comments are closed.