The Fed’s stress tests and severely adverse outcomes

I am reading the US Federal Reserve’s bank latest bank stress test analysis because a colleague sent me an alarming note about it. And so I wanted to run my thoughts by you.

I like the fact that the Fed is thinking in probabilistic terms and outlining different scenarios from best to worst case. But the question I have goes to which economic variables are the biggest driver of those scenarios and how asset prices are affected by those scenarios.

The Virus

I told you yesterday I think the COVID-19 crisis is the biggest variable here simply because it was what created the economic crisis. We have to remember that markets were tanking before the lockdowns were in place in Europe and the US.

You could argue that it was the Chinese lockdown and the busted supply chains that created the downside risk to the economy then, which caused markets to fall. But I would argue that we would still have had a substantial fall in economic output even in non-lockdown scenarios. And so I expect that the present rise in coronavirus cases will lead to a fall in economic output. This is especially true now that we see a reversal of the opening in both Florida and Texas. For me, the question is of magnitude.

I want to return just for a second to the horror chart I showed you yesterday.

Source: Le Figaro

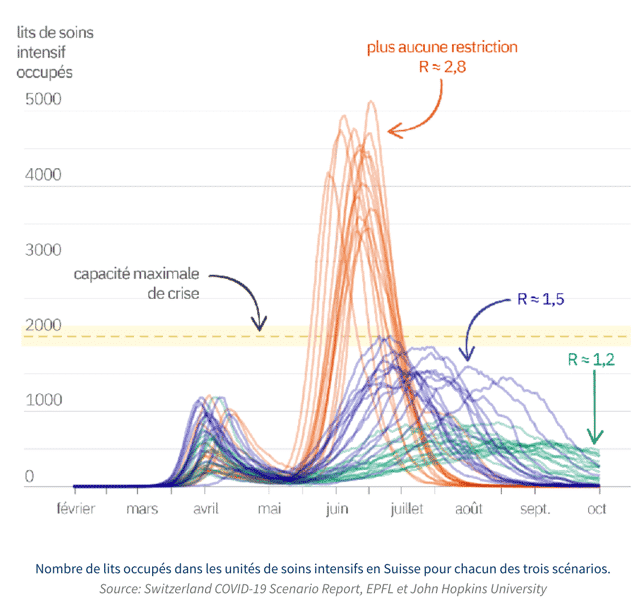

This chart from April is supposed to represent the then-possible outcomes modeled for intensive care hospital bed occupancy in Switzerland. And I am using it as a proxy for overall health care system overload driving decisions about movement restrictions and lockdowns. And so I am thinking about the model in terms of an individual European or North American country’s best base and worst case outcomes.

My translation of the Figaro article says:

Half a dozen teams of top-flight epidemiologists are currently working on future scenarios for Switzerland. One of them, made up of researchers from EPFL and John Hopkins University in Baltimore, in the United States, carried out predictions for the period through October. These scenarios bluntly show that perhaps the most difficult period is yet to come.

Depending on the parameters used, a second wave of Covid-19 cases could peak in July or August, pushing the Swiss hospital system very close to its limit in intensive care beds. This capacity has been increased from 981 to some 2,000 beds to cope with the crisis. At the end of this second wave, during which 5 to 6 million people will have contracted Covid-19 in Switzerland, the country will have between 15,000 and 21,000 deaths linked to the new coronavirus.

This scenario is not the worst case scenario – far from it. This is a scenario based on a reproduction rate of the disease – the R0 value – of 1.5 (blue lines on the graph). This means that each patient would infect an average of one and a half people. In February, before the containment and social distancing measures were decided, each person carrying Sars-CoV-2 infected almost twice as much, with an R0 of 2.76.

OK. Again, I saw this piece as sensationalistic at the time and still have misgivings about it now. There have only been 1958 deaths in Switzerland to date and these guys are talking about 15-21,000? That’s preposterous in hindsight, no?

But, let’s not dismiss the numbers completely yet. Consider the United States, where yesterday’s Covid-19 case count exceeded the highest levels from April. For the US, the simulations for Switzerland start to look more realistic – not the orange lines per se, but certainly the green and the purple/blue ones.

And it’s that fact which has caused Florida and Texas to dial back their re-opening – something which will directly and negatively impact GDP growth.

Bottom line: Much of the US opened prematurely and with inadequate social distancing guidelines. The result is a spike in infections, a partial shutdown of business, likely more deaths and economic pain.

The Fed’s Severely Adverse Scenario

That’s the vein in which we have to look at the Fed’s stress tests.

Here is the outcome from the February 2020 “Severely Adverse Scenario” the Fed modeled (link here):

The 2020 global market shock component for the severely adverse scenario is designed to be generally consistent with a macroeconomic background in which the U.S. economy has entered a sharp recession, characterized by widespread defaults on a range of debt instruments by business borrowers.Under the scenario, weaker obligors struggle to maintain their financial conditions due to material declines in earnings associated with the poor economic environment while rating agencies downgrade large portions of debt outstanding. The historically high levels of non-financial corporate debt to GDP amplify the losses resulting from the wave of corpo-rate sector defaults. This dynamic creates feedback effects between the economy and the corporate sector.

Spreads widen sharply for non-investment grade and low investment grade bonds as ratings-sensitive investors anticipate further downgrades and sell assets. Similarly, the leveraged loan market comes under considerable pressure. Open-ended mutual funds and exchange-traded funds (ETFs) that hold leveraged loans and high yield bonds face heavy redemptions. Due to liquidity mismatches, mutual fund and ETF managers sell their most liquid holdings, leading to more extensive declines in the prices of fixed income securities and other related assets.Price declines on leveraged loans flow through to the prices for collateralized loan obligations (CLOs).CLO prices suffer severe corrections associated with the devaluation of the underlying collateral and sell-ing by concentrated holders desiring to reduce risk.

The broad selloff of corporate bonds and leveraged loans spills over to prices for other risky credit and private equity instruments. Credit spreads for emerging market corporate credit and sovereign bonds widen due to flight-to-safety considerations. Asset values for private equity experience sizable declines as leveraged firms face lower earnings and a weak economic outlook. Municipal bond spreads widen inline with lower municipal tax revenues associated with the severe weakening of the U.S. economy.

Short-term U.S. Treasury rates fall sharply reflecting an accommodative monetary policy response to the hypothetical economic downturn. Longer-term U.S.Treasury rates fall more modestly as the UnitedStates benefits from a flight-to-safety. Short-termU.S. interbank lending rates rise as firms face increased funding pressure from a pullback in over-night lending, while longer-term swap rates fall in sync with the decreases in long-term U.S. Treasury rates. This is not a forecast of how monetary policy would necessarily respond to these conditions.

Flight-to-safety considerations cause the U.S. dollar to appreciate somewhat against the currencies of most advanced economies, except the Swiss franc and theJapanese yen. The yen appreciates against the U.S.dollar as investors unwind positions and view the yen as a safe-haven currency. The Swiss franc appreciates against the U.S. dollar as investors seek an alternative safe-haven currency. Safe-haven considerations cause traditional precious metals to experience an increase in value while non-precious metals prices fall due to lower demand from the general economic weakness.

This is extremely ugly. And it tells you why the Fed intervened in March and April. They were trying to prevent this outcome from becoming a reality. A second viral infection wave puts this scenario back in play. It moves it into the tail risk realm as something the Fed has to consider a reasonable worst case outcome. And this is why they have ordered banks to freeze dividend payments at current levels and to forego any share buybacks. Banks need as much cash as they can get their hands on to make sure they remain well-capitalized in a truly adverse economic scenario.

New Scenarios

The Fed has several updated economic outcomes that closely mirror the economic outcomes we have been discussing recently. Here’s what they say in brief:

V-Shaped Alternative Downside Scenario: “Relative to the scenario published in February 2020, this alternative downside scenario maintains the same level of financial stress but concentrates the macroeconomic stress early in the projection horizon…In the second quarter of 2020, real GDP contracts in this scenario by about 31½ percent at an annualized rate and the unemployment rate soars to a peak of 19½ percent. In the second half of 2020, GDP rises appreciably and the unemployment rate declines considerably. GDP growth remains above trend in 2021 and 2022, but the unemployment rate declines gradually and stays above the low levels of the first quarter of 2020 even at the end of the scenario.

Folks, it sounds like even in a V-shaped recovery. We aren’t back to square one by the end of 2022. And note: “By maintaining the same financial stress as in the severely adverse scenario, equity prices would still decline nearly 50 percent”.

U-Shaped Alternative Downside Scenario: “The unemployment rate in this scenario reaches a peak of about 15½ percent and remains close to that level for a few quarters before declining gradually to levels that are still well above the low unemployment rate of the first quarter of 2020.”

W-Shaped Alternative Downside Scenario: “The third alternative downside scenario is characterized by a “W-shaped” recession in which a second COVID event begins in late 2020 and leads to a second increase in unemployment and drop in GDP.”

This is the scenario we are living in right now. What does the Fed say:

consistent with a resurgence of cases of the virus in the winter, real GDP growth dips negative for a second time in the first quarter of 2021 to about-12 percent, and the unemployment rate rises back to 14 percent in 2021. The second recession is not as deep but has greater duration, with real GDP receding through the end of 2021and implying a cumulative contraction of 7½ percent for the span of the second dip. Interest rates on 3-month Treasuries remain at their lower bound for the duration of the scenario. The minimum yield on 10-year Treasuries is even lower than in the U-shaped alternative downside scenario

That’s it exactly. This is my base case.

Takeaways

Notice that the Fed is talking about economic scenarios divorced from financial conditions. What they are modeling is a severely adverse economic conditions outcome in alternative economic scenarios. There’s a sense in which doing this isn’t realistic because the financial economy and the real economy have feedback loops. But, even so, it’s a useful exercise for us to see because it gives us a sense of how the Fed is thinking.

How I am interpreting the Fed here is this: the Fed sees a primary role as one in which it must maintain steady and low inflation and low unemployment. But it also must maintain financial conditions to safeguard the financial system from a financial crisis. In my estimation, the Fed’s actions to date have been as much about preventing a financial crisis as they have been about creating financial conditions that foster low unemployment and inflation. In short, they are worried first about a crisis and second about the real economy.

If you take the view – as I do – that the real economy and the financial economy are interlocked, then you have to see the severely adverse scenario the Fed is outlining as more likely than it has been willing to admit – when the W-shaped recovery is happening right before our eyes. There is no way you can get a double dip without this having a negative impact on financial markets. And so, the Fed’s move to shore up bank balance sheets yesterday is the first warning sign on that score.

Let me go back to a question I asked yesterday:

If defaults spike, those spreads are going to gap right back out. And, in my view, that could be a trigger for a liquidity crisis in high-yield-land, triggering yet more defaults. To the degree we see a ‘policy error’ from the Fed, it would be here. What the right thing to do is, I don’t know. But, it’s worth considering the downside risk for high yield.

The way I am interpreting the Fed today, having read its stress tests is exactly as I couched it yesterday; the Fed thinks letting yields rise and defaults rise too much would be a ‘policy error’. It sounds to me like they are willing to entertain some selloff in shares and some rise in spreads. But, at some point, they are likely to intervene. In fact, we should now expect that.

So, expect a second dip in the economy. How much of a dip depends on the size of the coronavirus wave hitting us now. When that dip occurs, financial markets will be stressed and asset prices will fall. The Fed is prepared for that outcome. But if the fall becomes disorderly, the Fed will intervene. The question now goes to how much asset prices have to fall before the Fed comes riding to the rescue. Hopefully, we won’t have to find out. But, I suspect we will.

Comments are closed.