Just when you thought it was risk-on

Trade and Currency Wars

I am starting this article just ahead of the equity market open in New York. And S&P futures have the market opening down 1%. The market continues to be unsettled by the political uncertainty around the US-China trade war, with tariffs looking likely to go into effect tomorrow. Meanwhile the US 10-year bond yield is down to 2.43% again, with curve inversion remaining in place from 6 months out to three years.

For me, the hidden risk here is that a trade war becomes a currency war. Charlie McElligott of Nomura mentioned in his morning note that overnight, the offshore Chinese Yuan posted its third largest 4-day decline versus the US Dollar since the August 2015 mini-devaluation.

To the degree the onshore Yuan follows suit, we would have a situation that would add incremental pressure on the Fed to take an even more dovish stance going forward, Chairman Powell’s resistance notwithstanding.

The Market vs The Fed

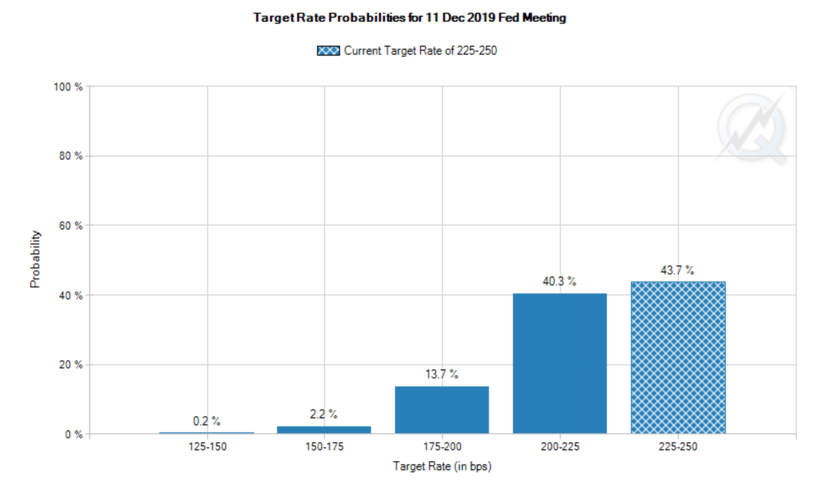

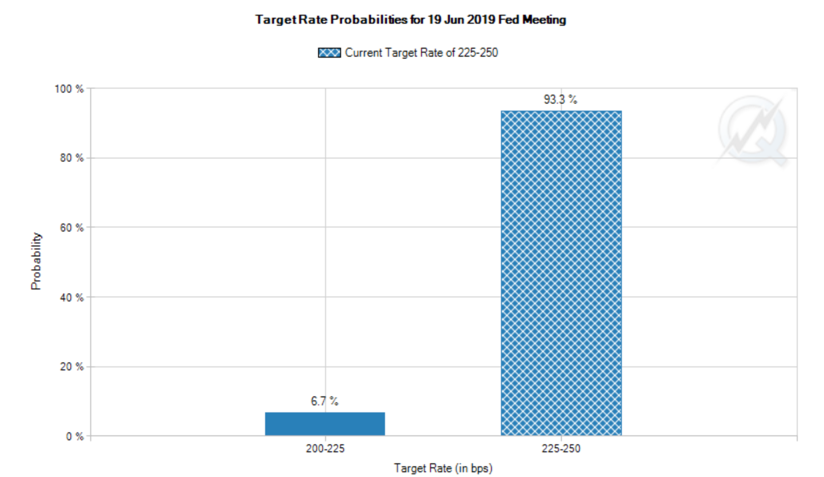

The market has been surprised that, while the Fed has made an historic dovish shift, it still is trying to resist going all the way dovish. For example, while Fed Funds Futures are showing near certainty for rates remaining on hold in the June FOMC meeting, they show more than a 50% chance of a cut by the end of the year.

Source: CME Group

The Fed is saying nothing of the sort right now. Chairman Powell’s last comments show absolutely no intention of cutting rates. So you have a bit of a standoff here, particularly given the Fed’s loss of credibility from its about-face in December. The market has interpreted that episode as the market forcing the Fed to heel, with Powell ultimately conceding that there would be a Powell Put just as there was a Greenspan, Bernanke and Yellen put too.

If we see a trade war and the concomitant impact on growth followed by a currency war, the pressure on the Fed will be that much greater.

The IPO train

All of the preceding commentary is more of the risk-off variety. Yet, at the same time, we can see that the ability of loss-making companies to go to market has not been dampened since the fear of missing out among equity fund managers is palpable.

Bloomberg has an interesting opinion piece on that score. And for me, it has the hallmarks of 1999 written all over it. Take a look:

The impending initial public offering of Uber Technologies Inc. promises to be a monumental event in more ways than one. If all goes as planned, investors — including Uber drivers and fund managers acting on behalf of pensioners and other regular folk — will give the ride-hailing company as much as $9 billion with astonishingly little clue about what they’re getting in return.

This isn’t how the stock market was supposed to work. To restore some discipline, regulators must redefine the rules of the road.

Like many of the “unicorns” that have come to market in recent years — including Lyft, Snap and Pinterest — Uber is asking investors for an act of faith. Its traditionally required disclosures, such as three years of audited financial statements, mostly confirm billions of dollars in annual losses. Beyond that lies the great unknown. Uber’s prospectus offers only the vaguest picture of how it intends to achieve earnings that could justify a valuation of $90 billion or more. It says little about nascent businesses such as scooters and driverless cars that are supposed to drive its growth.

Lack of information will encourage investors to be cautious, you might think. Indeed it should. But a troubling dynamic seems to emerge: the fear of missing out. Big institutional investors buy in to ensure that they won’t fall behind their peers. This gives their customers a bad deal. What’s worse, along the way, the IPO buyers may agree to terms that subvert the whole idea of public ownership of companies.

Herding and other idiosyncratic psychological heuristics managers employ to manage the risk of not under-performing are at work here. That’s where the fear of missing out comes from. So, I don’t see this mad rush into unicorn IPO names stopping anytime soon. In fact, it should gather pace.

Uber’s shares are set to price between $44 to $50 today ahead of tomorrow’s IPO. That’s below the whisper number $120 billion valuation. But, it’s still a lofty valuation for a company losing billions of dollars every year.

My View

Despite the near-term risks that trade and currency wars present, I don’t see these factors knocking the US and global economy off course enough to change the overall direction of the economy or markets. We are still in a period in the US of tough comps that mean a slowing of year-on-year growth.

That compares to China, Europe and some EM countries were growth should be accelerating off a low base. Obviously, a trade war would negatively impact that growth though.

Comments are closed.