US GDP figures, more on the US and EU vs China, and social media’s comeuppance

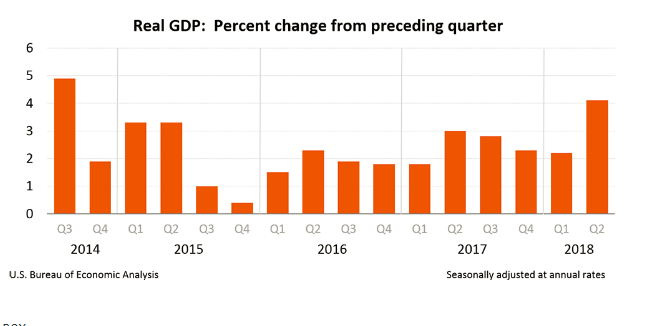

1. US GDP growth comes in at 4.1% for Q2

While the headline number was real growth for the quarter at an annualized 4.1% rate, the big deal was the inflation number attached to the headline number. Given the rise in GDP and in disposable personal income, and the relatively decent overall savings rate, this report makes four rate hikes in 2018 more likely. But the inflation numbers were lower than in Q1. And that gives the Fed scope to let the economy run without accelerating its hike timetable.

Source: BEA

Here are a few highlights from the report:

- Real GDP increased at an annual rate of 4.1% in Q2. That’s the highest in 4 years. Q1 real GDP growth was revised up to 2.2% from 2.0%.

- The GDP price index increased 2.3% compared to an increase of 2.5% in Q1. The PCE price index increased 1.8% compared to an increase of 2.5% in Q1. If you exclude food and energy prices, the PCE price index increased 2.0%, compared to an increase of 2.2%.

- Disposable personal income increased $167.5 billion, or 4.5% in Q2. That compares to an increase of $256.7 billion, or 7.0% in Q1. In inflation-adjusted terms, we saw an increase of 2.6% versus 4.4% in Q1.

- The personal saving rate — personal saving as a percentage of disposable personal income — was 6.8% in Q2, that’s compared to 7.2% in Q1.

Why this matters: The Trump administration has an official goal of GDP growth of 3%. The average during the current expansion is only 2.2%. And the Fed’s gauge of the long-run “capacity” of the US economy is 1.8%. Right now, the US economy is running ahead of all three of those figures on a year-over-year basis.

That puts the Fed in tightening mode. And likely, the US has edged marginally toward the likelihood of a December rate hike on the back of these figures. The missing ingredient is inflation. And Fed Chairman Jerome Powell has discussed this, most recently from a hawkish tilt in his remarks to Congress 10 days ago:

As I mentioned, after many years of running below our longer-run objective of 2 percent, inflation has recently moved close to that level. Our challenge will be to keep it there.

Deeper analysis: So the situation is a bit complicated for the Fed, especially given the pressure President Trump has applied recently. The Chairman’s stated view is that inflation is rising more quickly. But this report shows inflation moving down, if anything.

At the same time, given the President’s pressure, the Fed may want to err on the side of tightening to retain credibility about its political independence. All else being equal, this report moves us marginally in the direction of four rate hikes this year and an accelerated timetable for 2019.

The Republican message for the midterm elections will be that the Republican party’s economic policies under Trump have changed the arc of growth and that we need to retain a Republican Congress to ensure this growth continues. From a political perspective, these numbers help the Republicans by bolstering the President’s case for second-guessing ‘the elites’ who have said US economic growth could not be lifted sustainably.

2. The White House confirms the US and EU vs China thesis

After the US-EU summit, my “1 Big Idea” segment yesterday was that the US and the EU would squash their trade spat and ally against China. The lack of specifics yesterday meant this was pure speculation. But now the White House is confirming that this is the direction the US and EU are headed.

Trump’s Director of the National Economic Council, Larry Kudlow, was on Fox Business yesterday making just those points. He indicated that the deal Juncker and Trump hammered out would see immediately start work on increasing purchases of American liquefied natural gas, soybeans, and beef. And he said that the EU would join forces with the US against China in the WTO. Here are his exact words:

The U.S. and EU will be allied in the fight against China, which has broken the world trading system, in effect. President Juncker made it very clear yesterday that he intended to help us, President Trump on the China problem.

Why this matters: this is an important development for multiple reasons. Here are two big ones:

- The EU-US detente means les downside risk for those economies. Perhaps it was the US domestic auto industry’s opposition to auto import tariffs that convinced Trump. However, you look at it, it seems to be a major-de-escalation by Trump with one of the US’s traditional allies. And that lessens the risk that the US and EU economies will be impaired because of higher import costs.

- Key US export sectors in agriculture and energy were addressed. During Trump’s disastrous European visit, the US President called Germany “captive” to Russia because of a claimed dependence on Russian natural gas. This made headlines. But the bigger story was why Trump made those comments: a desire to stop the Nord Stream 2 pipeline and get the Europeans buying US LNG. With Juncker, Trump has met that goal. He has also got Juncker to thwart China’s soybean weapon. And he has further helped US farmers by getting Juncker to pledge to buy more American beef. I think this is a big win politically for Trump and it could help Republicans in the midterm elections.

Deeper analysis: Trump respects Juncker because he didn’t roll over in Brussels. And he also gave a credible threat that Trump could be damaged if US firms faced higher costs in the EU’s large market. This is one reason the EU exists, by the way – to give heft to their collective economies on the world stage. But Juncker also played to Trump’s domestic needs by playing up the LNG angle, and agreeing to do something on soybeans and beef. And the Europeans were much more open to the US anti-tariff position than expected.

That left the door open to switching the emphasis from EU-US animosity toward US-EU partnership against China, where both trading blocs have similar problems: non-tariff barriers, intellectual property theft, and corporate espionage.

3. Social media hits a wall

The weak results from Facebook were not the only poor showing from social media. Twitter’s results were underwhelming as well. And Twitter looks to be following in Facebook’s footsteps, with shares down massively in pre-market trading.

The bottom line numbers were good, with the social media company earning a profit for the third quarter in a row and revenue of $711 million, up 24% from last year and exceeding the expectations of $696 million. But as with Facebook, Twitter seems to have hit a wall on user growth, with the number of monthly users falling 1 million versus the previous quarter to 335 million.

Why this matters: the ongoing debate over social media regarding growth of the space is whether the outlay on internet security to better police political meddling by Russia and bullying and hate speech online is what’s responsible for the slowdown. The one narrative is that this is just a hiccup for the social media giants as they adjust to a new world in which they must spend more to keep their users safe. And while this will negatively impact margins in perpetuity, it will not affect growth for more than a few quarters. Twitter’s numbers arguable point in this direction.

But Twitter has had growth problems for some time. And the second narrative is that social media’s growth is behind it. This is now a mature vertical. And monthly usage gains will slow or move in reverse. And in this narrative, the social media giants need to better monetize existing users and find ancillary sources of revenue growth outside of social. Facebook’s inability to monetize Instagram point in that direction.

Comments are closed.