Chart of the Day: Government Deficits as Far as the Eye Can See

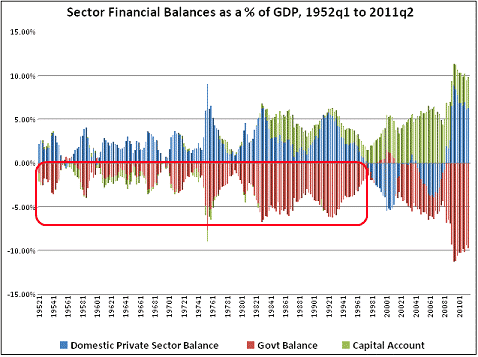

The chart below from the blog Pragmatic Capitalism shows the U.S. Federal government deficit for each quarter since 1952. As you can see, almost the entire period is marked by deficits.

Here’s my take, using the same chart a year ago that Pragmatic Capitalism used above today:

The U.S. dollar is the world’s major reserve currency. Especially in the post-Bretton Woods world, this has meant capital account surpluses as foreigners accumulate U.S. dollar reserves. These capital account surpluses translate into current account deficits. So the "normal" situation, as Randy [Wray] put it, absent a depreciating dollar, is a U.S. current account deficit. Moreover, Randy writes that a private sector surplus is also normal. And I assume this is true absent some sort of malinvestment-induced capital spending or household dissaving spree. So, while Randy puts normal in quotation marks, I think there is something to this state of affairs being the baseline case for the U.S. sectoral financial balances.

[…]

My analysis here says that the Clinton years’ achievement was due largely to a booming economy fuelled by a capital spending binge in the telecom sector and by business generally, mixed with an unsustainable decrease in household savings. Barring a repeat of this – something I would argue is a bad thing – the only way to get around the government deficit is to depreciate the dollar. Right now, getting back to full employment should be the first priority. That would go a long way to reducing the deficit. However, one must accept that government deficits are inevitable with the world’s reserve currency; the private sector is net saving and the capital account is in surplus. Otherwise, you really need a major devaluation, a reduction of reserve currency status or a private sector binge. I vote for a reduction of reserve currency status.

Clearly then, deficits in and of themselves are nothing unusual. What do I think about deficits as far as the eye can see? I would argue they are the norm since government deficits in aggregate allow the private sector to net save.

What about the forward-looking view? Here’s Fed Chairman Ben Bernanke’s take from earlier today:

Fiscal Policy Challenges

In the remainder of my remarks, I would like to briefly discuss the fiscal challenges facing your Committee and the country. The federal budget deficit widened appreciably with the onset of the recent recession, and it has averaged around 9 percent of gross domestic product (GDP) over the past three fiscal years. This exceptional increase in the deficit has mostly reflected the automatic cyclical response of revenues and spending to a weak economy as well as the fiscal actions taken to ease the recession and aid the recovery. As the economy continues to expand and stimulus policies are phased out, the budget deficit should narrow over the next few years.

Unfortunately, even after economic conditions have returned to normal, the nation will still face a sizable structural budget gap if current budget policies continue. Using information from the recent budget outlook by the Congressional Budget Office, one can construct a projection for the federal deficit assuming that most expiring tax provisions are extended and that Medicare’s physician payment rates are held at their current level. Under these assumptions, the budget deficit would be more than 4 percent of GDP in fiscal year 2017, assuming that the economy is then close to full employment. Of even greater concern is that longer-run projections, based on plausible assumptions about the evolution of the economy and budget under current policies, show the structural budget gap increasing significantly further over time and the ratio of outstanding federal debt to GDP rising rapidly. This dynamic is clearly unsustainable.

These structural fiscal imbalances did not emerge overnight. To a significant extent, they are the result of an aging population and, especially, fast-rising health-care costs, both of which have been predicted for decades. Notably, the Congressional Budget Office projects that net federal outlays for health-care entitlements–which were about 5 percent of GDP in fiscal 2011–could rise to more than 9 percent of GDP by 2035. Although we have been warned about such developments for many years, the time when projections become reality is coming closer.

I have to agree with Bernanke here. There is no reason for the U.S. to maintain a ‘structural’ deficit of 4 percent. It is unsustainable in that it leads to an ever increasing government debt to GDP. And as American society ages, it is probably going to get worse.

From a structural perspective, in the US, the deficit is caused almost exclusively by defense and non-discretionary spending i.e. military spending and entitlement spending (Medicare, Medicaid, and Social Security).Other discretionary spending is pitifully small compared to these items. In fact, if you were to eliminate all non-defense discretionary spending today, you would still have an enormous budget deficit. And I would add that it will kill aggregate demand in the short-to-medium term. No one wants to touch non-discretionary spending because its politically radioactive to do so. On this score, I agree with David Stockman.

So what about the Cult of Zero Imbalances – the notion that the deficit must be as close to zero over the business cycle as possible? I would agree with Marshall that this is an artificial political constraint. For example, if nominal GDP is growing at 6% and the budget deficit averages 4%, then the debt-to-GDP ratio is falling inexorably toward zero. Is there a need to move toward a zero balance in this situation?

I would take the following policy view then:

- Cyclical deficits are just that cyclical. Raising taxes or reducing spending before you reach full employment is likely to increase these cyclical deficits.

- Deficit sustainability is an artificial construct. The concept is usually based on a flawed view that taxes fund government expenditures when every dollar, euro, or pound in your pocket is an IOU created by government out of thin air aka fiat currency. Debt-to-GDP constraints are better at framing sustainability. But these too are artificial and are implicit indications of fears of cronyism and government waste.

- Deficits matter only to the degree they steal real resources from productive use. This can be surmised from a rapidly rising debt-to-GDP ratio.

So, deficits are the norm if you want a net savings position for the private sector. But, yes, I do think the US deficits are too high. We are far from full employment and the promises we have made to Americans on Social Security and healthcare are NPV negative. This ensures a diversion of real resources into those sectors and I believe this will erode growth as it already has in aged economies like Japan, Germany and Italy.

Also see:

I don’t see how saying G deficits are too high follows from the rest of your commentary. The previous statement was “Deficit sustainability is an artificial construct.” It may make more sense to say, “Government deficits are too high because the dollars are being poorly allocated. Deficits of this size should result in something closer to full employment.”

Also, it only makes sense that there will be significantly higher spending on healthcare and public pensions when the population ages. It may even have to double. The surest way to add a burden to the working population is to cut retirement benefits.

Are you basically saying (as Denninger does) that this https://market-ticker.org/akcs-www?get_gallerynr=2321 can’t continue? Or am I totally missing the point here – I often find I do with MMT related stuff..

There is also the problem with who gets the surplus? With US wages pretty stagnant then the share of wealth for US household savings should be stagnant as well. So the corporate sector should have a smaller surplus.

As for the government deficit it can be altered by changing the level of overall defence spending which has an exceptionally low stimulus multiple (0.4, ie it reduces overall GDP). It would be far better to reduce defence spending significantly and transfer the same sum to works programs or unemployment benefits which have multipliers greater than 1.7, Raising the retirement age and increasing contributions will make significant dents in the costs of pensions, and making them sustainable.

Simply reducing deficits reduces the size of the economy, unless something else replaces it. The simple equation Y=C+G+I+(X-M) means that if surpluses are to be the norm, then, in order to maintain the economy then either Wages (C), Investments (I) must increase or there must be significant import substitution to the point where it offsets the cuts in government spending. Though every government is trying that policy. Who will take on the role of deficit provider in place of the US? An investment lead boom would be difficult to offset the drops in government spending and excessive capital investment leads to its own problems. The problem for the US is that if it did start to export a lot more then the inflow of extra dollars would raise the exchange rate cutting off exports. Then hot money might follow. I think that the only way of maintaining such a policy will be with capital controls.

yes, yes, raise the retirement age and eliminate the death tax. Then neo-feudalism will be complete!

I would also like to see other changes to pensions that would end caps on contributions. As for death taxes I am actually in support of them. As for being supportive of neo-feudalism, there is no way that I would support such policies. With life expectancies increasing it becomes essential that contributions increase or retirement ages are pushed back to make pension schemes sustainable, public or private.

I wonder what the US deficit projections would look like if their

healthcare spending was closer to the developed nation average or if they

taxed energy usage like the Europeans. But then is that thinking just befuddled by looking at economics purely through what an identity equation implies?

If healthcare was lower then I suspect that Wall street would find a way to get that extra income into its coffers. As for energy taxed at the same rate as Europe then it would mean much lower imports and higher gas tax revenues, lowering the deficit considerably.