Bubbles: Jeremy Grantham, Fingers of Instability and the Medium Term View

I was reading a summary of Jeremy Grantham’s remarks in GMO’s recent quarterly analysis. And it occurred to me that a lot of what we see there is predicated on some embedded longer-term assumptions that I want to make clear. Grantham is talking about the potential, even likelihood, of a bubble in equities by 2016. This has to worrying because it would usher in another period of deleveraging. But it also assumes that the real economy gets us through 2016 via expansion. Some thoughts below

The Grantham piece and another one by Edward Chancellor, an expert bubble watcher, are labelled: Looking for Bubbles, Part One: A Statistical Approach and Part Two: A Sentimental Approach. Here’s the thesis. The US equity market is 1.4 standard deviations above norm and has a greater than 50% chance of going to 2 standard deviations above intrinsic value – or a full 100% overvaluation – by late 2016. Value investors don’t chase momentum. As such, they become out of step as markets rise above intrinsic value. This puts pressure on value investors during long periods of overvaluation via fund outflows due to underperformance and the psychological pressure of ‘losing face’ with investing peers. But value managers should resist the temptation to deviate from their value script and wait for the inevitable mean reversion that will follow the bubble.

This looks right to me. As I have written increasingly, there are all sorts of indicators that a risk seeking return mentality has infected a wide swathe of markets, compressing yields and buoying stock values. The question is how long can this go on. Grantham is saying it can go on for a lot longer, and could reach general bubble proportions as a result. Interestingly, Grantham defines a bubble in the same way I define bubbles, as a two-sigma event, something that on a Gaussian Bell Curve is in the 98th percentile of market events.

Now, related to this, on Friday we had Physicist Mark Buchanan on Boom Bust to talk about power law events in nature and financial markets.

I read Buchanan’s book “Ubiquity” some 14 years ago when it was released in 2000 and found the discussion there very enlightening. What Buchanan says is that many events in nature and the financial markets have event patterns defined more by power law probability distributions than by standard Gaussian bell curve distributions. This is what produces so-called fat tails. The way he describes it in the book is that fingers of instability build that individually could end in a market dislocation. If you think of a forest of trees, then the instability could lead to a forest fire. In markets, it leads to a market hiccup or melt-up. Now, when enough fingers of instability build up in nature, what happens is a catastrophe of unpredictable size and scope, an earthquake of 5.0 or 6.0 or 7.0 on the Richter scale or a forest fire of 100 acres or 1000 acres or 10,000 acres. The key here is that the fingers of instability come together to form a potentially catastrophic outcome that cannot be predicted in time or size but that varies in an exponential magnitude that is not consistent with a Gaussian distribution.

In markets, Buchanan explains quite well that this is because the traditional economic simplification of price movements as independent of prior price movements is wrong. Market prices are not independent of prior price movements simply because markets are a social function in which actors base their actions in part on the actions of one another. We have momentum investors for a reason. And while price actions seem random when market observations occur close to the probability mean, the lack of independence in price movements becomes ever more important the further prices veer from the mean. And that means that fingers of instability develop. Chancellor describes some of them:

- This-time-is-different mentality

- Moral hazard aka Greenspan/Bernanke/Yellen put

- Easy money

- Overblown growth stories

- No valuation anchor

- Conspicuous consumption

- Ponzi finance

- Irrational exuberance

These are the elements that induce investors to reach for yield and chase momentum as the market goes higher and higher. And eventually you get to a critical state where these fingers of instability lead to a crash. Combining what Chancellor, Grantham and Buchanan are saying into how I couch these things, you get a cyclical bull market predicated on a risk seeking return mentality that continues upward until the real economy forces a re-evaluation of risk profiles en masse. That means the real economy is key in determining how long the momentum carries upward. It is difficult to continue a cyclical bull market through a recession for example, though bull markets can survive a mid-cycle pause. Therefore, to take us from 1.4 sigma to 2 sigma and bubble territory, we need the real economy to hold.

Grantham implicitly says it will hold because of the Presidential Cycle.

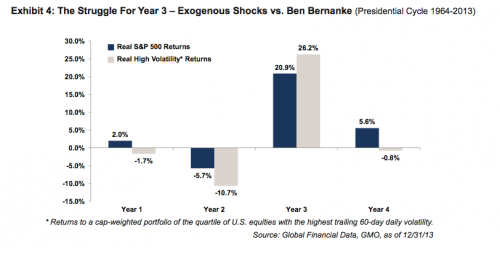

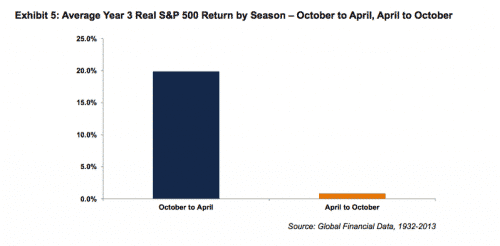

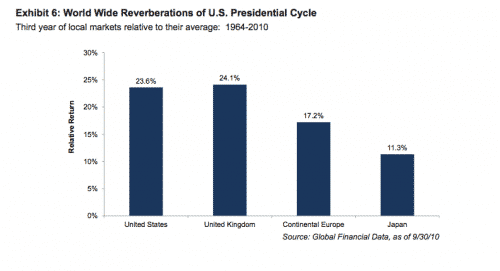

Now, this chart is couched in market terms, showing a massive return for the third year of a US Presidential election cycle, perhaps goosed up by monetary policy. But I want to think about this in terms of the medium term view of the US and global economy. If markets are sunk by recessions but can survive mid-cycle slowdowns, a Presidential Year uptick in markets that takes us through the Spring 2016 has to be consistent with an economy that is growing through 2016. And that means no recession this year or next year.

Question: how would markets respond to a US economy that is growing 2-2.5% annualized with +250,000 jobs per month and wage growth of 2%? I believe markets would stay in a risk seeking return mode irrespective of whether the Fed tightens. And remember, tightening into frothy markets in the asset-based economy pulls forward credit demand and actually accelerates growth. So, a positive US economic outlook would mean a Fed signalling tightening via tapering of QE in 2014 and hiking rates in 2015. That would mean rising credit growth through early-to-mid 2015, at which point the leveraged bets would start to come unstuck. And the cycle would turn down in 2016, such that by summer and fall of 2016 we would be roughly where we were in summer and fall 2008 and summer and fall 2000.

I think this is a plausible scenario. Nothing in the US looks likely to materially alter this train of events. The slowdown now ongoing in emerging markets and the risk from the Ukraine situation could change the growth path. For example, Indonesia just recorded its worst growth quarter since 2009. And we have seen material slowdowns in all of the BRICS, Brazil, Russia, India, China, and South Africa. I don’t think these economies are important enough to move developed economies into recession. So we will have to wait for the tightening and the credit downturn to precipitate recession in the US. For now, expect the real economy to support a risk-on mentality, excess leverage and multiple expansion. There is no indication that an end is in sight.

Comments are closed.