The Long Term Refinancing Operation was the hidden bazooka

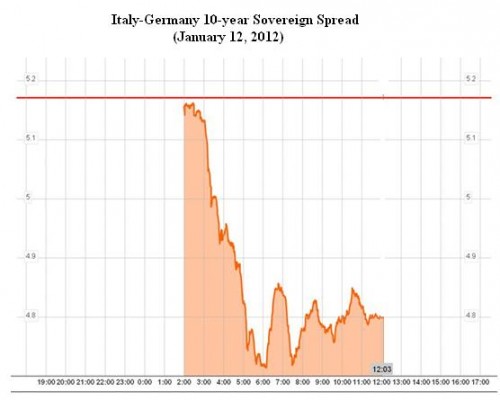

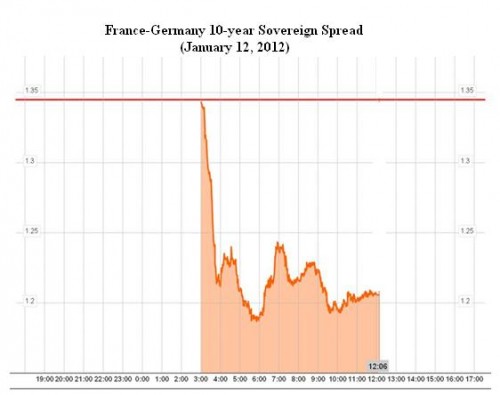

After the better than expected Spanish bond auction, eurozone sovereign spreads came in significantly yesterday. Even before today’s auction, the widely watched Italian 10-year bond yield had fallen to 6.63 percent.

The return of confidence, in our opinion, is the continuation of the markets’ realization that the ECB’s Long Term Refinancing Operation (LTRO) was the hidden bazooka in the last EU summit, which took a systemic banking crisis off the table in the short-term. Though risk remains elevated, the LTRO directly addressed the funding problem and liquidity crisis in the European banking system.

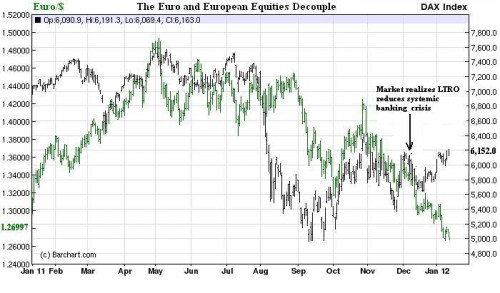

This is reflected in the break of the correlation between the Euro and European equities in mid-December. We have been closely monitoring this relationship to signal a potential confidence inflection point in the eurozone’s sovereign debt and banking crisis.

Note in the chart below the Euro and European equities, as reflected in the German DAX, traded almost tick for tick for most of 2011. The divergence began as the markets realized LTRO greatly reduced the systemic risk and the potential collapse of Europe’s banking system.

Rather than hoarding gold and fretting over the collapse of the Euro, Germans are now openly discussing the hidden “blessing” of the European crisis. Tuesday’s Der Spiegel’s piece, Europe’s Crisis Is Germany’s Blessing, wrote,

Its neighbors may be suffering, but the euro crisis has created conditions that actually benefit the German economy. Not only is the government enjoying the windfall of negative interest rates on bonds, but unemployment is down and exports are booming.

It’s every debtor’s dream. When asked for a loan, the bank not only agrees, but actually pays the borrower for their patronage. It sounds like a fairy tale, as though the laws of the market economy had been suspended. But on Monday it really happened.

The debtor in this case was the German government, which borrowed €3.9 billion ($5 billion) for the next six months at the unbelievable interest rate of -0.01 percent. Even the German Finance Agency was stunned. “This has never happened before,” a spokesperson said.

The Finance Ministry should be pleased. In the last four years, they’ve had to shell out around 1.8 percent in interest for such bonds. But recently even interest rates on German bonds with longer maturities have decreased significantly. The federal government is saving a bundle.

The European sovereign debt crisis is far from over and the LTRO directly addresses only one of the four issues driving the sovereign/banking crisis in the eurozone:

- Sovereign liquidity/funding – ability of sovereigns to rollover debt maturities at sustainable interest rates. The markets are still looking to the ECB for a short-term liquidity backstop for Spain and Italy.

- Sovereign debt sustainability and solvency – This has been the primary focus of EU policymakers and can only be realized with long-term structural adjustment policies in the highly indebted countries. Policies that promote growth must be an integral part of structural reform. The key risk is reform fatigue and political populism.

- Bank funding/liquidity – The LTRO addresses this issue and takes the financial collapse scenario off the table and elevates “muddling through” as the base case scenario.

- Bank capital and solvency – European banks still need to raise large amounts of capital and EU leadership has been weak, in our opinion. Balance sheets need to be strengthened to allow for bad debt to written off/down. This will take some time and depends much on market conditions.

We find interesting the policy juxtaposition of the EU, who appear more focused on longer-term structural adjustment, with the U.S., who are experts at short-term stabilization and fall short at addressing longer term structural issues. The ultimate survival of a cardiac arrest patient needs both short-term and long-term care. Until both approaches are incorporated into a fully consistent policy response, in both, the E.U. and U.S., global market and business confidence will remain depressed.

Hidden might not be the right word.

https://wallstreetexaminer.com/uploads/graphic1339.png

https://wallstreetexaminer.com/2012/01/09/fed-transparent-only-if-the-facts-are-bullish/