Really Nominal GDP

by Annaly Capital Management

Released by the BEA this morning: the advance reading of real GDP came in at 3.2% for the 4Q of 2010 (actually, it was 3.17%, but who’s counting?) versus expectations of 3.5%. There was a lot of internal noise, with large positive contributions from personal consumption and net exports, offset by negative contributions from inventories and government spending. However, the line item that jumped off the page was the GDP deflator, the measure of inflation that turns nominal GDP into real GDP.

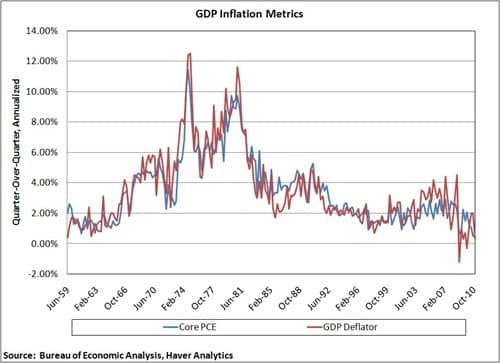

The GDP deflator was very light at only 0.3%. If it had come in as estimated (1.6% according to Bloomberg), and all other inputs remained constant, real GDP growth would have been cut in half. A smaller deflator pads real growth by subtracting a smaller number from nominal growth. We read one possible explanation for the light deflator: oil is an import, and imports subtract from GDP, therefore higher oil prices subtracted from the GDP price index. What we do know is that the core PCE price index (a preferred Fed measure of inflation) also declined, and the GDP deflator tends to track Core PCE over time despite the quirkiness of GDP accounting. The current level of Core PCE, 0.4%, is the lowest on record since 1959.

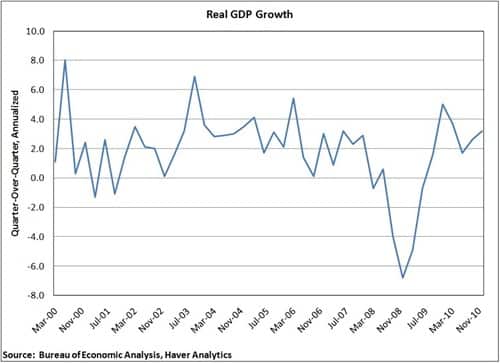

As mentioned above, low and falling inflation has the effect of padding real GDP growth. The chart below shows the recent trend in real GDP growth.

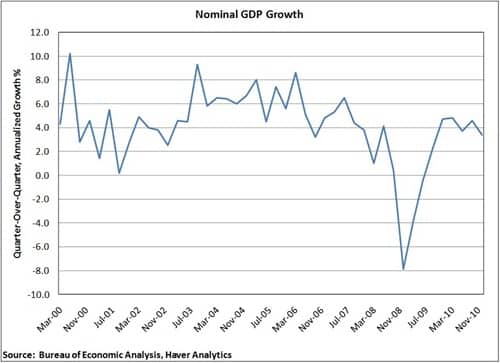

However, remember our small and shrinking deflator? The one that we said seemed to be skewing real GDP higher? Take a historical look at nominal GDP growth, and the recent economic activity looks different.

Average nominal growth since the late 1940s is about 6.8%, which included the inflationary 1970s and early 1980s, but this doesn’t seem way off. During expansions in the past 30 years, growth has averaged about 6.4%. Current nominal growth is at 3.4% and has been trending down throughout 2010. Considering that we are 6 quarters into an expansion with plenty of unusual stimulus to boot (+$2 trillion Fed balance sheet, +$1 trillion federal deficit), this low level of nominal growth and inflation is surprising.

Contrary to economic theory, & Nobel laureate, Dr. Milton Friedman, monetary lags are not “long and variable”. The lags for monetary flows (MVt), i.e. the proxies for (1) real-growth, and for (2) inflation indices, are historically (for the last 97 years), always, fixed in length. However, the FED’s target?, varies widely.

Short term money flows are accelerating. Long-term flows just bottomed. The combination obviously creates a high ratio of real to nominal gDp (a potential thorn for targeting nominal gDp – as opposed to inflation).

Contrary to economic theory, & Nobel laureate, Dr. Milton Friedman, monetary lags are not “long and variable”. The lags for monetary flows (MVt), i.e. the proxies for (1) real-growth, and for (2) inflation indices, are historically (for the last 97 years), always, fixed in length. However, the FED’s target?, varies widely.

Short term money flows are accelerating. Long-term flows just bottomed. The combination obviously creates a high ratio of real to nominal gDp (a potential thorn for targeting nominal gDp – as opposed to inflation).

Good article – but I have a question: I’m pretty sure that the US exclude food and energy prices from the CPI. Now, its my understanding that these are rather high at the moment (or so my fuel needle tells me). What sort of effect would you guess these to have on your analysis if they were included? Would they be in any way significant?

US CPI includes food and energy costs. It is the so-called core CPI which strips them out, ostensibly to gauge the inflation trend by not having the number biased by food and energy which are volatile components in the short-term. The median CPI measure does this better by including food and energy but stripping out the most volatile data points from any individual month regardless of its source.

The GDP deflator on the other hand is different because it is the measure that takes nominal domestic production and makes it ‘real’ production i.e. transforming nominal GDP into real GDP. To do this, you have to exclude imported prices like energy. So right now, with food and energy costs rising, the GDP deflator is very low. This was a big part of why US GDP was so strong. Consider this a statistical aberration.

Good article – but I have a question: I’m pretty sure that the US exclude food and energy prices from the CPI. Now, its my understanding that these are rather high at the moment (or so my fuel needle tells me). What sort of effect would you guess these to have on your analysis if they were included? Would they be in any way significant?

US CPI includes food and energy costs. It is the so-called core CPI which strips them out, ostensibly to gauge the inflation trend by not having the number biased by food and energy which are volatile components in the short-term. The median CPI measure does this better by including food and energy but stripping out the most volatile data points from any individual month regardless of its source.

The GDP deflator on the other hand is different because it is the measure that takes nominal domestic production and makes it ‘real’ production i.e. transforming nominal GDP into real GDP. To do this, you have to exclude imported prices like energy. So right now, with food and energy costs rising, the GDP deflator is very low. This was a big part of why US GDP was so strong. Consider this a statistical aberration.

It is well known that Americans always polish their feathers nicely when it comes to economical statistics.

For example it is a little known fact that real GDP over the last decade was only 1%.

Yes that is including the Dubya tax cuts, credit & housing boom + all the stimulus money.

Only 1% a year…

You can check it out for yourself at:

https://www.bea.gov/national/nipaweb/SelectTable.asp?Selected=N

Choose table 1.1.6 and select the correct time frame (10 years back of course).

It is well known that Americans always polish their feathers nicely when it comes to economical statistics.

For example it is a little known fact that real GDP over the last decade was only 1%.

Yes that is including the Dubya tax cuts, credit & housing boom + all the stimulus money.

Only 1% a year…

You can check it out for yourself at:

https://www.bea.gov/national/nipaweb/SelectTable.asp?Selected=N

Choose table 1.1.6 and select the correct time frame (10 years back of course).

The problem is that food and energy which are volatile and make a considerable proportion of the low paid’s expenditure. They do not buy the items that lower the overall inflation rate. As such many peoples standard of living falls because of that alone. Longer term unless something is done to address poverty and unemployment I can easily see the US go the way of Tunisia and Egypt.

The problem is that food and energy which are volatile and make a considerable proportion of the low paid’s expenditure. They do not buy the items that lower the overall inflation rate. As such many peoples standard of living falls because of that alone. Longer term unless something is done to address poverty and unemployment I can easily see the US go the way of Tunisia and Egypt.