A brief look at the Asset-Based Economy at economic turns

This morning I again wanted to challenge my somewhat bullish medium-term outlook but bearish longer-term view on the US economy – this time by looking at the data on debt. What follows is going to be a very numbers-heavy post. So, I apologize in advance if you are not a numbers jockey like me. But, do bear with me; I think you will find the analysis useful.

Now, as I write this paragraph, I have compiled the data, but have not yet dissected it. So I approach this without any definitive conclusions at the outset (although I must admit the last time I saw the data last year, they supported my thesis). Let’s see if the data still support my beliefs .

The Asset Based Economy View of America

My pre-conceived thesis is as follows:

- The U.S. has been living beyond its means for a generation as reflected in the increase of debt to GDP across a wide-spectrum of sectors of the economy.

- This increase has not been worrying to policymakers because they have only been watching debt service burdens, to the degree they have been tracking debt.

- Because of “the Great Moderation,” interest rates have fallen, permitting a secular increase in debt to GDP levels without increasing debt service burdens.

- The Federal Reserve has a dual mandate to support economic growth (through full employment) while maintaining low consumer price inflation (through price stability). Cognizant that debt services burdens were not acute and consumer price inflation was low, the Federal Reserve was able to target asset prices through lowering the Fed Funds Rate as a mechanism for reviving the economy when cyclical downturns occurred.

- As a result, the Federal Reserve under Sir Alan Greenspan followed an asymmetric monetary policy of only increasing interest rates slowly in the face of large levels of asset price inflation but reducing those rates very quickly to stem asset price declines.

- The result has been a belief that the Fed would save the economy when it ran into trouble, the so-called Greenspan Put. This has increased the appetite for risk in the financial sector and, most crucially, has meant that debt levels always increased after a brief downturn. The heroic actions of the Bernanke Fed have only increased this belief in the Fed as economic savior, sowing the seeds of the next asset bubble.

- This Asset-Based Economic Model can last through several business cycles – but will eventually collapse when debt service burdens become too large.

So, in sum, I believe that we are now poised to either a) collapse under the weight of debt only if debt service burdens are too much to bear or b) continue apace in the Asset-Based Economy until these burdens do eventually become crushing. I see b) [this originally said a) erroneously. A reader caught the mistake. Freudian slip?] as the more likely outcome during this cycle. Whether that crushing level of debt eventually comes as the result of a decline in incomes not matched by a decline in debt burdens (deflation) or via an increase in interest burdens not matched by an increase in incomes (inflation) is a question for another day.

What I want to look at here is the narrow issue of how debt burdens have moved at turns in the economic cycle. Specifically, I am about to examine the debt to GDP levels of specific sectors of the economy as presented by the Fed Flow of Funds right around recessions. And then I will compare these levels to the growth in nominal GDP and draw conclusions based on the data (debt cannot grow more than nominal GDP for long or it is a clear sign that growth is predicated not on sound investment and productivity but on leverage).

So, this is not an exercise in crunching the numbers to fit a conclusion, but rather a look-see at whether the data supports my thesis.

The Numbers: Federal Reserve Z1 Data Series

The Federal reserve releases a data series called Z1 every quarter. This is the basis of my analysis (link at the bottom). The Z1 series shows debt from the following sectors of the economy:

- domestic nonfinancial sectors credit market instruments, excluding corporate equities liability

- households and nonprofit organizations credit and equity market instruments liability

- households and nonprofit organizations home mortgages liability

- households and nonprofit organizations consumer credit liability

- nonfinancial business credit market instruments, excluding corporate equities liability

- nonfarm nonfinancial corporate business credit market instruments liability

- state and local governments, excluding employee retirement funds credit market instruments liability

- federal government credit market instruments liability

- total finance credit market instruments, excluding corporate equities liability

- rest of the world credit market instruments, excluding corporate equities liability

My pre-conception is that the sectors I want to key in on are the mortgage market (3), the household sector (4) and financial services sector (9)

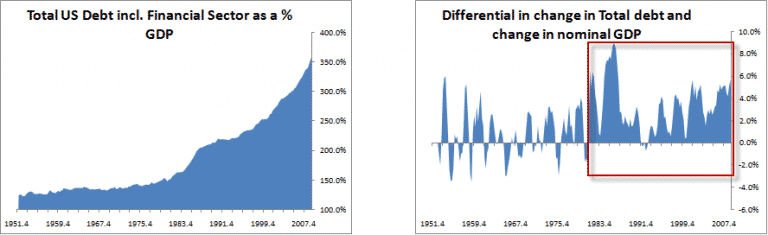

Total Debt

What should be abundantly clear from the two charts below is that the U.S. has been growing in an unsustainable way since the recession of 1982. There was a brief period during the 1990-91 recession when the change in nominal GDP outstripped increases in debt levels, but that’s it (note, I use year-over-year change levels throughout). This is completely at odds with the preceding period in which every recession induced declines in debt to nominal GDP comparisons.

Debt levels at the end of Q2 2009 are 357% of GDP, a massive increase from the 160% that prevailed in 1982. The data clearly demonstrate that since 1982 the U.S. has relied on an increase in debt, even during recession, to avoid downturns. My thesis of policy asymmetry is, therefore, confirmed.

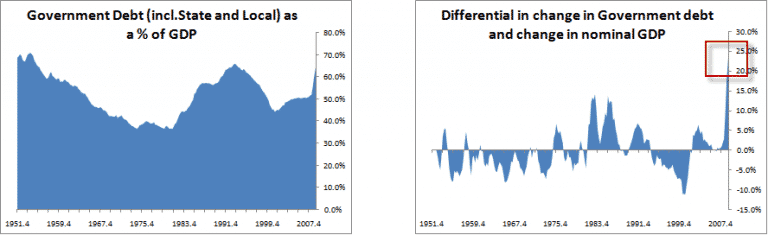

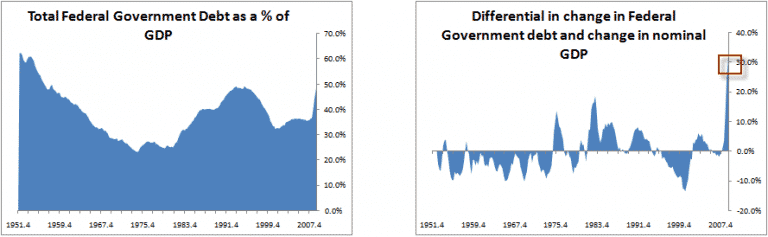

Government Debt

This chart is fairly benign when you look at aggregate levels as a percentage of GDP. Pundits forecasting an imminent increase in U.S. interest rates because of too much government debt have obviously not looked at these data. However, what is striking is the huge and unprecedented surge in debt as a percentage of GDP since the latest downturn hit. This discrepancy to nominal GDP cannot go on indefinitely. My general conclusion is that deficit spending can indeed continue for a long time without stoking an increase in interest rates given the low level of government debt as a percentage of GDP. This is bullish for U.S Treasuries in a muddle through economic scenario.

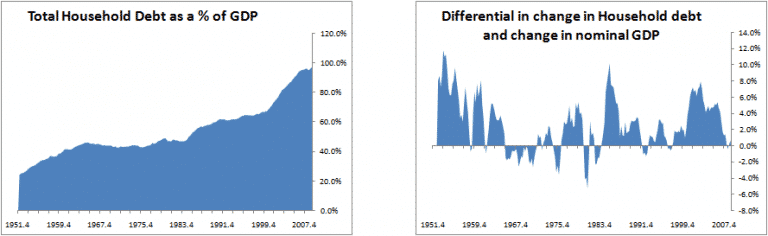

Household Debt

There is less here than I anticipated. One thing is clear: the household sector has breezed through the recessions in 1990-91 and 2001 without decreasing debt significantly. As a result, the increase in debt levels in the household sector are pretty astonishing. In 1952, it began at 24% of GDP, rising to around 40% by 1960, where it remained through the Ford presidency. Afterwards, it shot up again to its present 97%, four times the level a half-century ago.

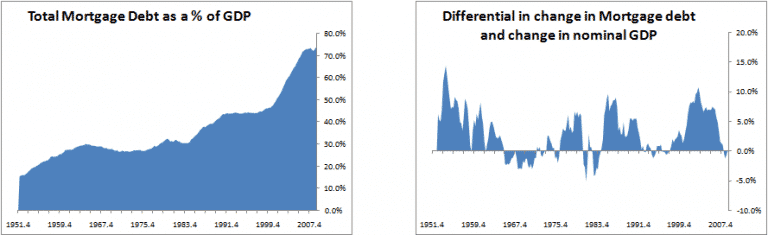

Mortgage Debt

This pattern is largely the same as the previous one.

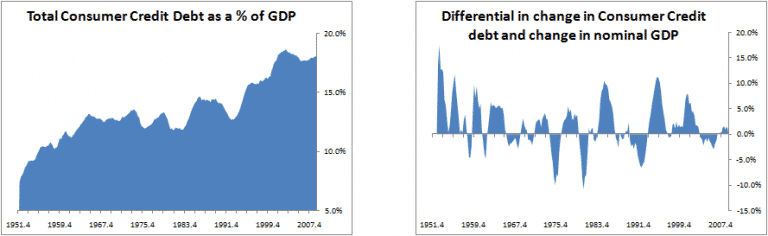

Consumer Credit Debt

Consumer Credit seems to be much more volatile than mortgage credit. You can see the fluctuations in comparison to nominal GDP are greater. And the absolute amounts are much less than in the mortgage market. The conclusion I draw from this is that,to the degree household debt levels have increased unsustainably, it is mortgage debt which is to blame.

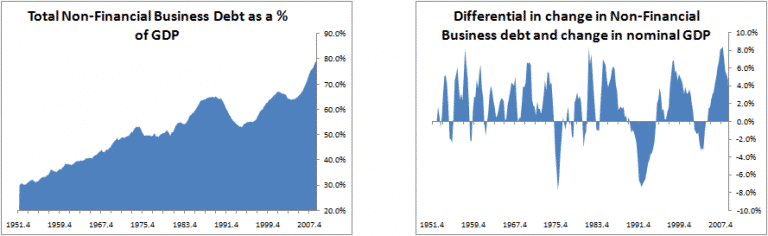

Non-Financial Business Debt

There is a lot more volatility in capital spending as reflected in non-financial business debt levels as well. Nevertheless, there has been a secular increase in debt levels of the business sector, from 30% in 1952 to the present 78%. The one thing to notice on the chart on the right is how short business cycles were pre-1982. It is more striking in that chart because business debt levels always adjust during recession.

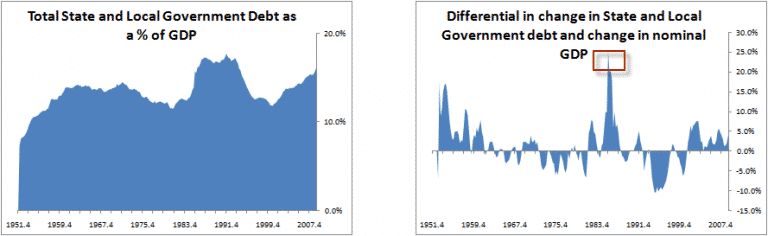

State and Local Government Debt

Since the 1960s, state and local government debt levels have been basically flat as a percentage of GDP. There is not much to say here except to note the huge spike in the mid-1980s relative to nominal GDP. Can someone explain this for me? I think that area circled in red is quite intriguing.

Federal Government Debt

This chart looks basically the same with the total government debt charts as Federal Government debt dominates. What you should notice is that debt levels are lower now than they were in the 1950s and have just passed the post 1950’s high-water mark in 1993 of 49%. Again, this does suggest there is ample room for deficit spending without an increase in interest rates. The data are more favorable for treasuries than I had anticipated.

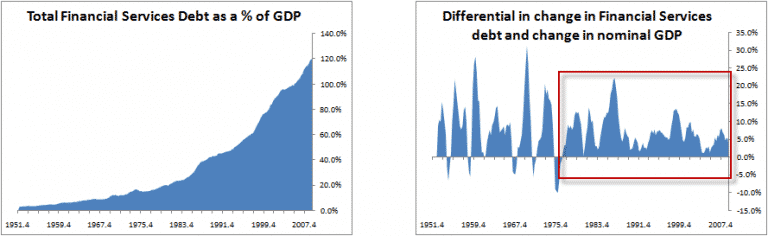

Financial Services Debt

This is probably the key damning piece of data confirming the asset-based economy thesis. The data are much worse than I expected. Not only do Financial Sector debt levels rise from negligible to percentages well over 100% of GDP, but the entire post-1982 period sees zero decline compared to nominal GDP until last quarter.

What conclusions can one draw here?

- The financial services sector is six times more important than in 1982 when its debt is measured as a percentage of GDP.

- The financial sector protected the American economy since 1982 by increasing its debt burden relative to nominal GDP even during recession.

- The financial services sector contracted in Q2 relative to GDP for the first time since 1982. If this is a rear-view mirror view, that means recovery could continue. However, if this is a canary in the coalmine, that is negative for the U.S. economy. This number bears watching.

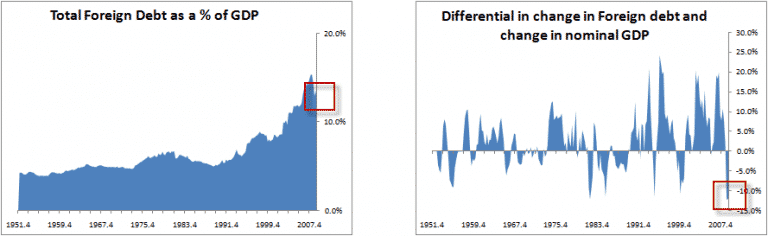

Foreign Debt

There was an absolutely massive decrease in foreign debt relative to GDP when the economy was falling. Q4 2008 saw a gap of -12.4% between the change in foreign debt and the change in nominal GDP. The year-over-year differential has diminished as Q1 and Q2 2009 saw foreign debt increase, albeit to a level much lower than in Q3 2008.

Conclusions

Most of my basic beliefs regarding the asset-based economy are still intact. What now seems clear to me is the degree to which the post-1982 period is a departure from the one which preceded it. Moreover, the data on the financial services sector was surprisingly stark. I would go as far as to say that the US economy depends on leverage in the financial services sector to continue growing. I come out of this thinking it is the financial services sector more than the household sector dictating the course of events. And as the financial sector just began to really deleverage in Q2, it bears watching how this proceeds.

As for the household sector, aggregate debt levels are not decreasing substantially – not in mortgages or consumer credit. This may have changed in Q3 but given the fact that the worst of the recession was in Q4 2008 and Q1 2009, the data suggest that the consumer will not deleverage. If deleveraging doesn’t occur in the mortgage market, the household sector will not be the cause of a double dip. So, not having looked at debt service levels yet, I am not anticipating an imminent downturn in consumption demand or a further increase in savings – although this could change based on the data.

In the end, my somewhat more bullish medium-term outlook is justified by the data. Here, I am not talking about longer-term sustainability but the prospects of a multi-year recovery. Watch debt levels in the financial sector as a contrary indicator.

Source

Z1 Data Series – Federal Reserve

Hi Ed,

“As for the household sector, aggregate debt levels are not decreasing substantially – not in mortgages or consumer credit.”

Actually households ARE deleveraging significantly with respect to the size of their outstanding debt… the effect just looks smaller with respect to GDP than it does for financials because financial debt is much larger. But they are connected and household deleveraging can accelerate financial deleveraging… Oh and one other reason the effect looks smaller is of course that GDP has contracted… so the debt reduction in nominal terms does of course get partially offset by falling incomes (a mild version of the classic debt deflation nightmare scenario).

Look at the Fed’s graph of Total Consumer Credit Outstanding. Then the same data in percentage terms. Falling at almost a 5% annual rate and still accelerating! And this data is monthly so more recent than FoF data (though consumer deleveraging has been occurring since late 2007).

I’ve been playing with the FoF data too… you might be interested in these graphs the first of which shows that government borrowing has canceled out deleveraging (for now) and halted GDP contraction. That may not last depending on how stimulus plays out…

I also pulled together some graphs on Japan’s battle between private deleveraging and government borrowing (guess which wins?) that may foreshadow what is to come in the US, depending on political outcomes.

Actually I misspoke — I meant that consumer deleveraging has been since the end of 2008, not late 2007. Also I still agree on the bullish outlook for treasuries whether we ultimately follow a Japan or Great Depression path.

I will definitely take a look at your graphs. As for the household sector, I have been following the consumer credit numbers which the Fed releases and they are definitely falling in Q3, I agree. That is why I want to see the Q3 and Q4 data to see what the trend is. So, when I say there is no deleveraging in the household sector, I mean in the FoF data through Q2. I will admit that consumer credit looks a lot worse than the mortgage market: Nominal consumer credit levels topped out at 2.61 trillion in Q3 2008 and are now 2.52 trillion. But, on the whole, the data are not catastrophic – which was what i expected to see.

As I said in the post, consumer credit is much less important than mortgage credit. Unless, we see deleveraging there, I am now anticipating retrenchment less than I was before.

Good point… (didn’t read carefully enough, sorry). Mortgage debt is falling at a 1.4% annual rate as of Q2 (in the FoF data) but since GDP has fallen faster, mortgage debt to GDP has not yet fallen, so on those terms, no deleveraging yet. As you say, the data from the second half of the year will give a lot of insight. Personally I expect the trend to accelerate but we will have to wait and see.

wow! great article. thanks for sharing.

what about the unemployment effects on this theory and the fact that consumers cant add-on more debt (their credit worthiness suffered severely, particulary the home ATM). Savings slowly ticked up, but i agree not as much as expected @ end-of-08.

what r your S&P short-term-bullish targets? 1100s or 1200s? thanks!

“This Asset-Based Economic Model can last through several business cycles – but will eventually collapse when debt service burdens become too large.”

This seems a self-evident truth , yet policymakers have ignored it for a couple decades , at least , and continue to do so.

The graph you , or someone , needs to construct is one which posits what gdp growth would have looked like over the past 70 years or so if debt/gdp levels had remained at some arbitrary sustainable level — i.e. a level lower than today’s , maybe more like what existed in the ’60s.

In other words , show the world in a simple , visual manner what most of us sense intuitively , that much of the “growth” of recent decades was illusory , because it was based on compounding — thus , unsustainable — debt relative to gdp.

Such a graph would also help to disabuse people of the notion that the stock market accurately reflects underlying economic strength. Some people , at least. Kudlow & Co. , for example , are paid to resist such disabuse.

Great and extensive work and very well presented.

1. You say:

GOVERNMENT DEBT:

“This chart is fairly benign when you look at aggregate levels as a percentage of GDP.”

IMO looking at the end of this fiscal year, it’s not benign. Counting future retiree obligations even with a haircut, it’s ridiculously high. But any corporation would have to count those obligations.

2. Under Financial Services Debt, you say:

(3.)”The financial services sector contracted in Q2 relative to GDP for the first time since 1982. If this is a rear-view mirror view, that means recovery could continue. However, if this is a canary in the coalmine, that is negative for the U.S. economy. This number bears watching.”

What do you think of the view that the healthiest thing for the economy as a whole and especially for individuals (as opposed to AmEx) would be for the household sector to continue to deleverage and get to back to where it once belonged, which is not to spend money at high interest charges and spend what it has saved or is currently earning?

DoctoRx, you know I agree with your allusion to entitlement spending because of the stick I took at Naked capitalism for my “Means of reduction: Medicare and Social Security” post.

https://pro.creditwritedowns.com/2009/06/means-of-deficit-reduction-medicare-and-social-security.html

So, I see your point that interest rates could rise if we don’t see a credible path to longer-term fiscal discipline. However, I think the best strategy politically is to stay the course (on stimulus) until you are forced to deviate. Reining in stimulus now could be costly in the 2010 elections. I’m looking at this in terms of political calculus, which is how Washington operates (I’ll have more to say about my reasoned view of stimulus in a future post).

As for what’s healthiest, ballooning debt to unsustainable levels is reckless in the extreme. Yes, individuals should be deleveraging much more than they currently are. Over the long-term that is what is best for America.

But, apparently, no one gives a damn about the long-term.

“Because of “the Great Moderation,” interest rates have fallen,”

I would say interest rates have fallen because total labor costs have fallen, price inflation has come down, and the spoiled and rich want to “steal” from the lower and middle class in the high wage countries using negative real earnings growth, interest payments, and/or seizing the collateral/assets of the lower and middle class in the high wage countries.

“Cognizant that debt services burdens were not acute and consumer price inflation was low, the Federal Reserve was able to target asset prices through lowering the Fed Funds Rate as a mechanism for reviving the economy when cyclical downturns occurred.”

I don’t believe that is the whole story.

IMO, the fed lowered interest rates to sucker excess debtors further into debt and to get excess savers into more risky assets.

I believe that calculatedrisk has a post about retail sales and housing leading to recoveries. Would that actually be the lower and middle class going further into debt to increase retail sales and increase housing?

“This Asset-Based Economic Model can last through several business cycles – but will eventually collapse when debt service burdens become too large.”

BINGO! That probably happens when the labor market and the goods/services market get oversupplied. IMO, the fed does NOT care about the labor market being oversupplied. IMO, they like it that way because of that supposed wage-price inflation spiral garbage and that it leads to excess corporate profits for their business buddies.

However, the fed along with the spoiled and the rich can’t seem to believe that the goods/services market can get so oversupplied that fewer hours need to be worked. IMO, that was one of the points of getting the lower and middle class so far in debt, to “trick” them into working more hours in the present and in the future (as in NO retirement).

Hi Ed,

Great article, however I’m confused by your conclusion, where you seem to contradict yourself. You say that you consider a collapse to be the most likely outcome during this cycle. But you also think there will be a multi-year recovery.

Dodge

My mistake. I meant b) as the more likely outcome. However, I do think there is a large possibility of a double-dip.

Ed, I think this is one of the best frameworks for thinking about this crisis I have read yet. Thank you. I finally had an “ah ha” moment.

It seems to me, though, that the non-financial business number bears watching as well — non-banks can and will approach their balance sheets very aggressively and conservatively, and at $10T that is not an insignificant number … a decline just to 1 standard deviation of trend would offset quite a lot of growth in financial debt.

In addition, there will be more pressure on mortgates, also huge in aggregate so small changes are still big numbers. A change down would not necessarily be a function of good behavior on the private individual, but more likely writedowns. An unknown variable, but possibly big impact, at a minimum a drag.

It just seems to be with downward pressure on these two, the fin sector would have a hard time offsetting without an additional very aggressive boost from the fed gov’t.

I do feel a little ill about “ample room for deficit spending” — when you think of the tax rates following the 1950s … just really ugly … dreading those, and still assume they will be correlated with gov’t debt …

Ed,

How have you taken the following into account:

1)Demographics – at what point do the baby boomers actually start to worry about their retirement and start saving, (ie.. when do they turn Japanese?) regardless of their ability to take on more debt. The majority of baby boomers’ children are under water on their mortgages, so they can’t borrow any more.

2)The economy is being sustained almost solely by government debt. How long can this continue, not only before foreign lenders revolt, but Americans themselves demand that their government tighten the reigns (this may be a the issue that the Republicans choose as their battle cry in 2010)? By asking that the government not leave their children with a legacy of debt, will America not bring a double-dip recession upon itself?

One more point:

If the majority of toxic mortgages wind up on the government’s balance sheet, when the foreclosed house is eventually repurchased at a much lower price, if this if financed by a bank, the bank will show this as loan growth. But how does the toxic debt that must be written off get taken into account? Is there a time lag at all between these two events? Is it possible that these loans could be double-counted?

This may sound confusing, but I hope you get the idea I’m trying to wrap my head around.