The Cult of Zero Imbalances

Marshall Auerback here with a few thoughts about this economic cycle, external imbalances, fiscal stimulus, and current account deficits.

This is not the Great Depression. We are going to have “muddle through” here precisely because we lack the courage to deficit spend on the magnitude we did in World War II. We are spending too much time fretting about “external imbalances” (Martin Wolf’s latest piece in the FT, “The Urgency of Now” is an illustration of this: The resolution of external imbalances is the main problem and should be the policy objective right now.)

We are no longer operating under a fixed exchange rate regime or a quasi gold standard (much as some countries curiously want to recreate this). We have a flexible exchange rate regime, where capital inflows have to equal the current account deficit. Dollars flow out through the trade deficit (which is a large part of the current account deficit) as the US spends more on imports than it earns on exports. Those dollars are net saved by our trading partners and they are reinvested in dollar-denominated assets. If portfolio preferences of foreign net savers shift away from holding US dollar denominated assets, asset prices have to adjust until they are willing holders of the dollars they earn in trade (that is, interest rates must rise, equity prices must fall, until expected returns are attractive enough for foreigners to maintain their US dollar holdings). Also, if foreign net savers of dollars favor particular assets, like US Treasury bonds, for a variety of institutional reasons, then relative US asset prices can also be influenced.

The money that flows out through the current account deficit flows back in through the capital account. For a nation with a flexible exchange rate, there is no change in the money supply from trade activity. This is just the opposite of a fixed exchange rate system, of which gold based systems are one type, and that is why James Grant advocates leaving flexible exchange rate systems in the dustbin of history. In a fixed exchange rate system, money balances of trade deficit nations are drained off to the trade surplus nation, and the trade deficit can only be run until the existing money balances of the trade deficit are exhausted.

Neither foreign private or public entities can create US dollar reserves out of thin air. That is the charge of the US central bank and commercial banks. Foreigners have to earn dollars from sales of goods or assets to US dollar holders. So it seems to me that the imbalances Wolf describes are almost a necessity as far as the US goes.

That means the ultimate source of the credit to support US trade deficit spending could not have come from abroad as some have alleged. Rather, credit was created in the US as households engaged in mortgage equity withdrawal during the housing boom, and spent more than the earned. Neither foreign savings nor foreign capital inflows were required to create this credit. All that was required was a household willing to borrow with identifiable equity in their home, and a bank willing to expand its balance sheet, with new home equity loans creating new deposits out of thin air. The loan is made, which shows up on the banks asset side of the balance sheet, and the homeowner has a credit line it can draw down, which shows up on the liability side of the bank balance sheet. Nobody here or abroad needed to save beforehand for this money deposit and credit loan to be created.

So what happens when the housing bubble bursts? Equity in homes shrinks, mortgage equity withdrawal shrinks, bank balance sheet growth reverses, household deficit spending reverses as they begin to net save, the trade deficit begins to turn, foreign net saving is reduced, and foreign capital inflows to the US are also reduced. The trade deficit is the twin of the household deficit spending, and the household deficit spending was made possible by credit expansion by US financial institutions on the back of the housing bubble.

In other words, foreign saving and capital inflows are at the tail of the dog, not the head. The only way the tail wags the dog is if foreign portfolio preference shift suddenly or persistently against US dollar denominated assets or specific US asset classes, in which case asset prices must adjust to keep foreign investors willing holders of US dollar denominated assets. We must always be careful to distinguish between shifts in preferences with regards to existing holdings, and shifts in saving out of income flows. The two are not the same, but they often get conflated.

That is not to say the threat of foreign investors dumping US assets isn’t a danger, but it may not be the central risk, which as far as I can see remains the concerns of people who fret about today’s imbalances. To me, the central risk is that the US private sector is shifting to a net saving position in a dramatic way for the obvious reasons – loss of wealth, precautionary saving given recession, etc. Arguably, this needs to happen if households are going to pay down debt and reduce debt burdens, and if they are realizing capital gains are not guaranteed.

The risk of this necessary adjustment arises because if the private sector moves to a net saving position – spending less than it earns – the income level in the US will fall unless the trade deficit turns quickly enough, and unless the fiscal deficit expands commensurately. In other words, we should be applauding this increased fiscal deficit because the alternative would be disastrous, not just for the US, but the world as a whole.

For every net saver, there must be a net deficit spender, or else the net saving cannot be accomplished without an adjustment of incomes. This is where the so called paradox of thrift comes from, as you well know. If incomes fall, debt defaults and delinquencies will increase more dramatically, and there is a good chance of heading into a debt deflation spiral, a la Irving Fisher.

In Q4 2008, US nominal GDP fell. Incomes have started to fall. That indicates the private sector is trying to net save more than is feasible given the shrinkage of the trade deficit and the expansion of the fiscal deficit, largely through so called automatic stabilizers, to date.

I suppose you could argue that from a US only perspective, ideally all of the increase in the private sector net saving position would come from a reversal of the trade deficit, but this isn’t going to happen. China earns about 10 times as much on its external sector than the domestic market, so its decision to become an export juggernaut, taken in isolation, was perfectly understandable. But in a world where global trade is collapsing, in part because export dependent economies have just had the rug pulled out from underneath them as US consumers (and others) try to save, it is a fantasy to think the adjustment process can be done entirely through trade. The only way to avoid a debt deflation outcome, as long as the private sector is trying to increase its net saving, is through an expanding fiscal deficit. And the reality is that we don’t need a G20 summit to accomplish this. The US can do this on its own, as can Japan (as PM Aso indicated on the front page of your paper today). As the government spends more than it earns in tax revenue, private sector incomes are boosted, and the private sector can earn more than it spends. They are two sides of the same coin. In that sense, if you agree private sector deleveraging is necessary part of the adjustment process, or at least important, it comes at the price of public sector releveraging, barring a heroic reversal in the US trade deficit (which would throw our trading partners into an even more severe recession unless they also pursued domestic demand led polices, a la China).

To illustrate this, the current account deficit has already gone from about 6% of GDP to 4% of GDP. Let’s say further consumer and inventory contraction gets us to 2% of GDP by year end. The CBO suggests the federal fiscal deficit will be out to 12% of GDP. I think that’s a bit high, as it incorporates TARP. But even assuming a trailing deficit of 8% (which is roughly what we’ve got now in the US), the private sector can net save around 7-8% of GDP without nominal incomes falling in the economy. At the depths of the 1973-5 recession, private sector net saving hit a post WWII high of nearly 9% of GDP. Maybe it needs to go higher this time because of the larger shock to household balance sheets with home and equity price deflation. But at least we can say the fiscal deficit is now programmed to scale up fast enough to reduce or contain the risks of US income deflation, and hence a runaway debt deflation process. To me this is crucial.

So can the foreign trade and US household spending imbalances be adjusted? Yes, they can. Does that adjustment process create further challenges? Yes it can, to the extent massive fiscal deficit spending is required to allow the private sector to accomplish its net saving objective without cratering private incomes and setting off a debt deflation spiral.

Then the question really boils down to, can the massive Treasury bond issuance be placed, especially if a smaller US trade deficit means foreign investors have fewer dollars to reinvest in US assets?

Treasury bonds were once 40% of commercial bank balance sheets. They were below 1% last I checked. Default free securities might look attractive to banks these days, especially with a positively sloped yield curve. The Fed used to hold 70-80% of its assets in Treasuries, now down to 20%. The Fed will want to have plenty of Treasuries to sell into the market once the eventual recovery comes and private investor liquidity preferences fall.. Remember, the Fed has no budget constraint.

Does this imply an increase in liquid assets in the economy? Yes it can, but we are also undergoing a large financial sector deleveraging, and we have begun a household sector deleveraging as well for the first time in the post WWII period. As loans are paid backed, deposits are cancelled out, shrinking conventional measures of the money supply. Much of the credit in the shadow banking system has been obliterated, and will not be coming back soon.

Is there nevertheless a risk of a flight from the dollar to the extent the US is willing to be the first mover, and an aggressive one at that, down these paths of quantitative easing? Yes there is. Is there a risk investors seeing the more central banks pursing the quantitative easing path will take flight into precious metals and other real assets as prospective inflation hedges, even if product price deflation is showing up in more countries? Yes there is. Could that complicate the policy exit strategy to the extent some of these commodities, like oil, are inputs to production, and so higher commodity prices could lead to an adverse shift in supply curves (to the left in price/quantity space, as in stagflationary periods)? Yes it could. But I think the alternative of focusing first on the external imbalances between China and the US is the wrong way to go about it. Look at what happened to budget deficits during W.W. II: at its peak, the US budget deficit as a percentage of GDP went to 30.3% in 1943. Yet by the end of the war, US households and the private sector were once again in a position of massive savings surplus. This is the financial correlative to those huge government deficits on the side of the ledger.

Remember, there is no ‘cost’ to a federal deficit. It’s not a free lunch, it’s a free tool to prevent loss of output.

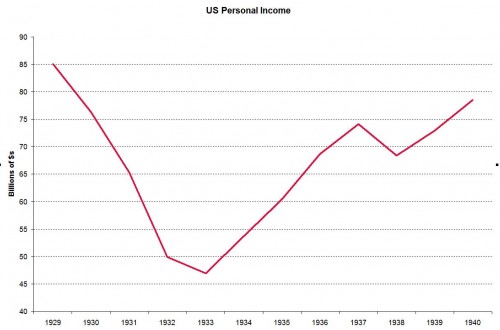

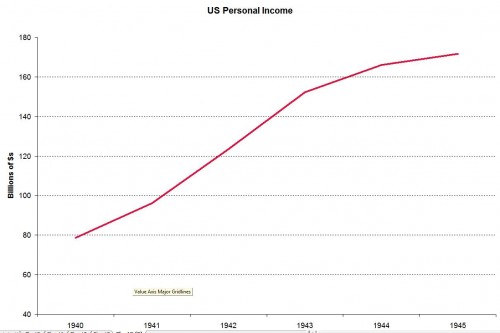

One last point about “muddling through.” Here are some graphs to illustrate the differences between now and the Great Depression (hat tip Warren Mosler).

Nothing remotely like this is currently in the cards. It was the last gold standard collapse. The US gold standard was abandoned domestically in 1934.

Nothing remotely like this will happen this time around. World War II deficits exceeded 20% of GDP annually. Currently Personal Income is muddling through with flat to modestly positive gains month over month. This is not the Great Depression.

“All that was required was a household willing to borrow with identifiable equity in their home, and a bank willing to expand its balance sheet, with new home equity loans creating new deposits out of thin air. The loan is made, which shows up on the banks asset side of the balance sheet, and the homeowner has a credit line it can draw down, which shows up on the liability side of the bank balance sheet. Nobody here or abroad needed to save beforehand for this money deposit and credit loan to be created.”

Disclaimer: I am not an economist, but an interested layperson looking to gain a better appreciation of what’s happening in this murky world

I understand what you’re saying when it comes to non-securitized HELOCs, or credit cards. In those cases I believe the bank does just loan out some money to the consumer, who then spends that money. I guess that’s all part of how fractional reserve banking works.

But in the securitized world, which was the majority of mortgage financing (and REfinancing, importantly), we had a lot of mortgages being funded by foreign purchasers with lots of dollars left over from their trade surplus with the US. It was their willingness to loan those surplus dollars back to us that enabled us to buy more of their crap, thereby sending the money back to them again.

So if the foreign nations were spending this money instead of saving it, surely they wouldn’t have had all these surplus dollars to loan back to us in the first place?

(be gentle, I’m relatively new to all this)

No, the causation is from loans to deposits as a matter of accounting I guess that’s all part of how fractional reserve banking works. fractional reserve banking is a fixed exchange rate/gold standard concept

Fact: they are no different anyone or any company that sells products and gets paid for them via a deposit that goes to their bank account.

Again, no, it was domestic credit that funded foreign ‘savings’ of $US financial assets. Once they got paid in $ balances in their bank account, they decided to exchange those financial assets for tsy secs which are nothing more than different accounts at the Fed. And in order to buy more, american consumers do more of same. get a car loan from a bank that creates a new deposit. ‘old deposits’

matthew,

Marshall is in London and asked me to take a stab at responding to your question. So here’s my take.

What I think Marshall is getting at is that all of the increase in credit which created those external imbalances was done in the U.S. That means that because of deleveraging, this credit has now disappeared, and so the external imbalance is also going away.

The problem is that the loss of credit means a shrinking economy and recession – a recession that I have labelled a depression with a small d but that risks becoming a Depression with a capital D.

What if the U.S. government stepped into the breach then by stimulating demand while the private sector saved? That would mean a huge deficit, which is what’s happening and that means those deficits need to be financed by debt that needs willing buyers.

This is where the problem lies that you are asking about. Doesn’t all that debt risk stoking inflation or a buyer’s strike? It does. But, this is ostensibly a problem that is more manageable than a deflationary spiral. (Remember that debt can be bought up by the Fed — which is inflationary but not fatally so)

The fact of the matter is you need to stop the deflationary spiral and its associated dead weight economic loss. The deflationary spiral is the Great Depression Armageddon scenario. But, stopping the spiral through deficit spending creates other problems which you have correctly identified. I see those problems as more manageable than the spiral and that makes it clear to me that we need fiscal stimulus.

Without it, you get Depression with a capital D.

yes, yes, yes! from your lips to the administration’s ears, mr auerback — let someone up there realize the futility and inherent destabilizing dangers of quantitative easing as well as the absolute imperative for fiscal deficits to quantitatively match private sector cash flows accumulating as ‘dead-head’ excess reserves in the banks.

I am not an economist either but I do wonder about this. You seem to have an either/or: fixed vs. flexible exchange rate. Then you argue, if I understand correctly, that our flexible exchange rate means there is no change in the money supply from trade activity.

Are you arguing that the fact we operate in a global economy with significant currency pegs is immaterial?

What exactly has been the effect of the yuan peg in your view?

Is a global economy of flexible exchange rates identical to an global economy where one of the major export platforms has a peg? If not, how do they differ?

It seems to me you are arguing against the notion of a distortionary effect of a global savings glut (funded by the Asian surpluses, in large part). But you assume flexible exchange rates, where actually that flexibility is impaired, in practice, by pegs.

I think what you are alluding to on the monetary side is similar to what Simon Johnson says : if inflation is driven by the output gap, we do not have a problem. If inflation is driven by fear of an emerging-market scenario, then we could get all sorts of trouble.

I’ve not been able to locate of Cult of Zero Imbalance people. No doubt they exist. Assuming they do exist, is it really worth it to gear an article on this broad topic, towards the supposed Cult?

Seems to me core of the problem has nothing to do with what people claim. Seems to me that the core problem is that inflows to support our Treasury and Agency market was our own consumption coming back to us, via CB buying. When global trade and US consumption collapsed, it was then prudent to look for significant diminishing of that dynamic. Now that this has happened, the FED is functionally monetizing the shortfall. The shortfall first arose on a discretionary basis in Agencies, and now it’s moved on to Treasuries. But the shortfall is no longer discretionary. One can read Setser who does a good job of tracking this stuff, for example, or just go right to the data.

Savings rate data shows that US savers cannot cover the annual budget shortfall. Inflow data shows USD reserve accumulation is down, and therefore foreign CB buying of Treasuries cannot make up the shortfall. So, The FED is making up the shortfall. If one listens to Mosler’s views, I will take it to mean this is not really a problem. That may be true.

However, I would argue that a nation that needs to monetize its own government bond issuance in order to fund itself–can do so as long as consensus reality is willing to put up with such an operation. However, in the world of economics, behavior–not mechanisms–is what determines outcomes. When the epiphany arrives unfolds, then 60 years of certain paradigmatic relationships will fall, because structurally they are already falling.