Case-Shiller offers up another depressing spectacle in U.S. housing

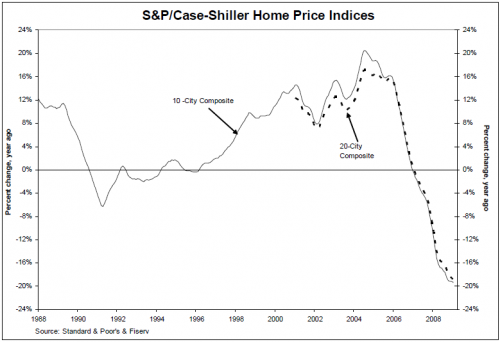

You might have thought house price declines were slowing. I certainly had hoped so. The latest data from January 2009 from the S&P/Case-Shiller index suggests this is wishful thinking as year-on-year declines hit another record of 19%. The decline was not only steep, but very broad-based.

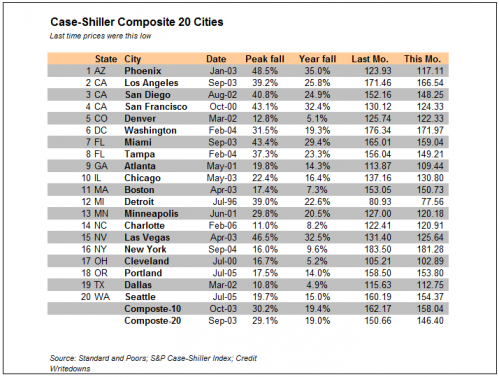

Data through January 2009, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, shows continued broad based declines in the prices of existing single family homes across the United States, with 13 of the 20 metro areas showing record rates of annual decline, and 14 reporting declines in excess of 10% versus January 2008.

House prices declined in every single market from December to January. This has been true for each month since Lehman started the latest phase of the credit crunch. We are now down 30% from the peak. Hardest hit are the former bubble markets in Phoenix, Miami and Las Vegas. San Francisco and San Diego have also lost more than 40% peak-to-trough.

I had said previously that I expected price declines to slow. The data are not supporting this contention. Therefore, I am moving to a more negative view of the U.S. residential housing market.

Given these types of price declines, it calls into question the assumptions by the Obama Administration regarding the worth of so-called toxic assets now at the heart of their plan to end the credit crisis. Certainly, if this type of price activity continues apace, residential mortgage related assets will continue to fall in value. Meanwhile deterioration in commercial property and credit card markets guarantee further writedowns at banks in the U.S. and elsewhere.

While I had said I do not foresee an average U.S. house price decline greater than 50%, I am not willing to make this statement. House price declines are accelerating, not decelerating.

Source

The New Year Didn’t Change the Downward Spiral of Residential Real Estate Prices According to the S&P/Case-Shiller Home Prices Indices (PDF) – S&P website

Can I throw something in from left field here? These data, and I assume they parallel those we will see from commercial real estate in the next few months, mean that the US gov cannot dig its way out of this by covering losses on derivatives based on mortgages and CRE loans. They can only print, print, print.

Yet the dollar has not collapsed. Nor has the Yen, despite Japan’s 15-year long quagmire in a similar mess. (Their CRE collapse occurred back in the early 1990’s). This reminded me of Peter Drucker’s claim back in the ’80’s that the finance markets had decoupled from the real economy. History proved Drucker wrong, but could we be seeing a similar decoupling between GDP and currencies? Again history may prove me wrong, but the Yen and Dollar strength as compared to the health of the Japanese and US economies do seem to support this view in light of current events. At least in this observer’s opinion.

I agree that it is looking dubious as to whether Geithner’s plan will cover the derivatives losses. And the easiest way out here is debasing the currency through the printing press, yes. I do see things headed that direction.

This is why I don’t see the dollar as a strong currency longer-term. There are problems here though:

Asset markets can remain artificially high for years. Look at JGBs. Who would think the Japanese could keep rates so low for so ong given the massive increase in debt.

All other central banks seem to be printing money too — at least the Swiss and the British are. And the ECB seems to have joined the party as well. While this all speaks to gold rising, it does not necessarily speak to a low dollar or yen

Who could benefit? The commodity currencies like the Norwegian krone or the Loonie and Aussie and Kiwi dollars, the Rand. But, again, this is problematyic because those economies are small, relatively speaking. There is a premium for liquidity. And I noticed the Norwegians recently said they don’t want people speculating in their market for that reason.

All of this speaks to the difficulty of figuring out what currencies are going to do. In my mind, hard assets are the only thing to gain in such an environment. Thoughts?

Thoughts?

Rising commodity prices imply a weaker dollar and that is where I am stuck. I would have fallen in with Schiff, Jim Rogers, Faber, et al that called for a collapsing dollar months ago. According to monetarist theory dropping the interest rate alone should weaken the currency. Printing dollars with a falling GDP alongside this should mean a double whammy. But so far we have *de*flation (ok, severe disinflation, bordering on deflation) not inflation. And no one can deny the money supply has gone exponential and interest rates can’t go any lower practically speaking.

The folks calling for a weak dollar are also, naturally, calling for gold to rocket. This obviously hasn’t happened either. Gold has been range bound for months and cannot seem to stay above $1,000 for more than a trading session or two.

My view on gold is that it is no longer trading like a currency analogue. This may change, but for the last few years at least gold has traded like any other commodity. I believe this is because the majority of traders no longer perceive gold as a viable currency alternative. Most folks trading today were just kids in 1970-1980, the last time gold was trading as a currency hedge.

So for the time being the dollar is the currency of last resort, not gold. I am aware this will likely change at some point and the minute it does I am jumping into gold and mining stocks with both feet, as I think the transformation could be quite rapid. Until this new state of mind vis-a-vis gold occurs I believe the dollar will remain strong no matter what its theoretical supply or what interest rate the Fed sets.

When the perception shift does occur, and I think this very likely, gold (and silver) will take off with a bullet.