Recession while GDP is growing?

Given my recent prediction for a positive GDP number in Q2 for the U.S. and after another positive number from Q1, how could I maintain that the U.S. is in recession?

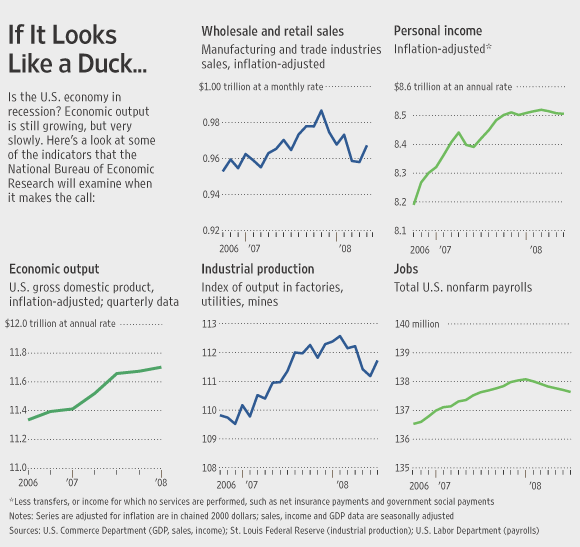

It’s simple. The commonly-held version of recession is misguided. Most people use the rule of thumb of two quarters of negative GDP to call a recession. However, as is evident from a Wall Street Journal article this morning, that is not what a recession is.

The nonprofit National Bureau of Economic Research, which decides whether the U.S. has slipped into a recession, looks for “a significant decline in economic activity spread across the economy, lasting more than a few months.”

–WSJ, 28 Jul 2008

So, what is a recession? Well, as the NBER says, they are looking across a variety of factors. This includes personal income, employment, sales, industrial production, and economic output.

So, GDP is only one of five factors that determine a recession

But, it so happens that usually all of these factors rise and fall together. So, the two quarters negative GDP has been a reliable shorthand. But, it is only a shorthand and it is likely that recession started in December 2007 or January 2008.

The question then is: why has GDP been growing if the U.S. is in a recession? My answer is two-fold.

The first part has to do with statistics. The GDP number inflates real GDP by using a very low number for inflation. Inflation is now 5%, yet last quarter’s GDP used an inflation number with a 2% handle. Had GDP been calculated correctly, Q1 2008 GDP would have been negative. I expect data revisions will correct this mistake. But, that will be long after it is important and no one will notice.

The second part has to do with consumption. When the economy is in recession and consumers are still spending, it suggests that consumers are over-spending and under-saving. The U.S. has been working on this consumption-is-king model for some time now. Isn’t it time this model got put to rest?

Comments are closed.