Oil’s Rising Baseline

Editor’s note: the price plateaus mentioned in this article are all in nominal terms. When using inflation-adjusted prices, prices have still risen dramatically, though less dramatically.

By Marin Katusa, Chief Energy Investment Strategist

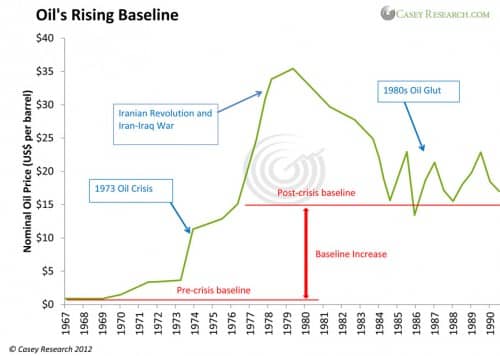

Between October 1973 and March 1974, the price of oil shot sky-high. OPEC embargoed its output, and prices spiked from $3 a barrel to $12 – a gain of 300% in six months.

For the global oil machine, the OPEC oil crisis sparked a complete overhaul. Oil-needy nations in the West rebelled against their reliance on OPEC, and within ten years non-OPEC production surged by 50%. Rising output in new areas even produced what became dubbed the 1980s Oil Glut.

But did prices go back down? Yes – and no. Yes, they went down – but not all the way.

The 1973 crisis was the beginning of oil’s rising baseline. In the 40 years since, prices have spiked and fallen numerous times, but oil has never returned to its pre-1973 levels (in nominal or real terms), even during the 1980s production glut. Instead, oil’s baseline price has crept continually upward.

(Click on image to enlarge)

It is not a corporate conspiracy nor a government plot. No, oil has become increasingly valuable over the last 40 years for two simple reasons. First, the world runs on oil. Second, with every passing year, with every million barrels pulled from the ground, oil is more difficult to produce.

We are not running out of oil. We are running out of oil reserves that are technically feasible, politically accessible, and environmentally acceptable.

As a result, the world’s insatiable thirst for oil is pushing the oil sector to the limits of its capabilities. Global production is only a few million barrels above consumption… a tight balance that is easily disrupted.

Disruptions, real and threatened, have kept the spot price of Brent crude above $100 a barrel almost consistently since early 2011. Today we face several real supply disruptions, including sanctioned Iranian output and low production from Libya and the Sudans, as well as one looming threat in the form of Israeli-Iranian aggression.

But Iran itself is not the problem. The Libyan revolution alone did not push prices to $125 per barrel. These situations just added fuel to an existing, smoldering, smoking fire: the global oil crunch.

A child doesn’t break out in hives after eating peanuts unless he has a peanut allergy. A guitar string doesn’t reverberate after being plucked unless it is under high tension.

And the price of oil doesn’t spike after one threat of disruption unless the entire oil-supply chain is highly strained – and strained it is.

Demand keeps rising. Production is struggling to keep up. The cost to produce a barrel keeps climbing, and the risks associated with each barrel keep increasing. The system is so strained that every bump in the road has the potential to cause oil-market mayhem. And with every bout of mayhem, oil finds a new, higher bottom.

Bigger and Bigger Baseline Bumps

Four years ago the International Energy Agency warned of the need to invest $20 trillion in energy projects over the next 25 years to supply the industrial revolutions in Asia and prevent an energy crunch. That warning stole headlines in 2008, but then came the crash. With global markets flailing, economies in recession, and energy demands declining in many part of the world, we shifted our collective attention to other matters.

When the Arab Spring pushed oil prices up 40% in a few months, we considered it an isolated event. When Iran started threatening to blockade the all-important Strait of Hormuz, we let ourselves believe that oil prices would come back down once the threat subsided.

And they will – but not all the way.

We now live in a world where oil trades above $100 a barrel even in recession. The baseline has risen, and the forces working to push it even higher get stronger every day.

In 1973 the price of oil shot from $3 a barrel to $12. Prices stayed in that range until the Iranian Revolution in 1979, and the start of the Iran-Iraq War in 1980 pushed them higher, to a nominal peak of $38 a barrel.

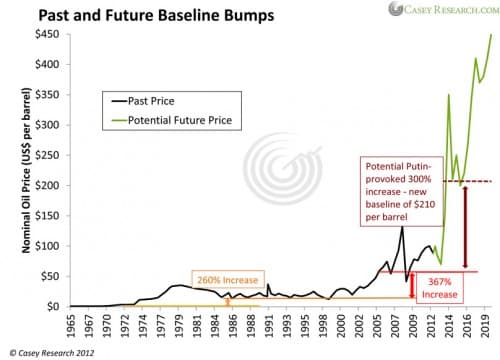

By 1986 pricing deregulation and surging production finally pushed oil down again. It bottomed at $11 a barrel. While a nice change from $38 a barrel, that bottom was still 260% above the pre-crisis low of $3.

And while it would be nice to think that a 260% increase in the baseline price of oil was an isolated event, that would be wrong. In fact, we are currently in the midst of an even bigger baseline bump.

From the late 1980s until 2004, the price of oil ranged between $15 and $30 a barrel (aside from one short spike at the outset of Operation Desert Storm). Today, I would say oil’s baseline price is $70 a barrel – less than that and important production like that from the Canadian oil sands, America’s shale basins, and the reams of deepwater wells around the world become uneconomic. If they go offline, falling output will boost prices up again. In addition, most OPEC nations need an oil price of at least $80 a barrel to meet their social spending requirements.

That means oil’s baseline jumped from $15 a barrel to $70 a barrel in the last ten years. That’s an increase of $55 a barrel or 367%.

That 260% baseline jump from 1973 to 1986 doesn’t look so bad anymore, does it?

A bigger baseline bump makes sense, because the strains on the system are stronger now than they were then. Demand is higher, production is riskier and more costly, and competition for increasingly limited resources is rising.

That begs the question: If increases in the baseline price of oil get bigger with every major spike, what does that say for the future of oil?

A Thought Experiment

Today, just as in 1973, the world’s top oil producers are in prime position. Armed with the most valuable commodity on the planet, they know that they can use their oil weapon to gain not just wealth but power. It would only take one leader from one such country to make a self-interested move, and we would face another major baseline bump.

There is a strong candidate in the wings for that very job, in the form of Vladimir Putin. Using resource wealth to benefit Mother Russia is Putin’s bread and butter – he even based most of his graduate school work on the topic, including this paper.

I have written several articles in recent years about Putin’s push to gain global power through strategic resource-based relationships. For one, I am certain that Putin is moving to corner the global uranium market and have positioned my subscribers to benefit from this shifting uranium landscape. Putin has also spent more than a decade building new gas pipelines to ensure that Europe remains reliant on Russian natural gas for years to come – the man loves being in charge of other people’s energy resources.

Oil is no exception. People very often forget that Russia – not Saudi Arabia – is the world’s top oil exporter. And with fields in Russia’s far north expected to produce billions of barrels in the years to come, Vlad’s grip on the global oil machine is only going to tighten.

So imagine this: in a marriage of convenience, Putin inks a series of lucrative supply deals with China. The Chinese Communist Party has the money, Putin has the oil, and the pipelines are already being built – the scenario is not so far-fetched.

Suddenly, the global oil-supply cushion disappears. With other major oil exporters facing increasing domestic demand and/or sliding production volumes, the disappearance of excess Russian supply forces oil-needy nations to look to higher-cost, higher-risk countries to slake their crude thirsts.

The result: Oil prices spike once again. When the immediate spike subsides and prices decline again, the world finds it has taken yet another step up the oil-baseline staircase. What was expensive yesterday becomes oil’s bottom tomorrow.

(Click on image to enlarge)

History says that another baseline jump of 300% or 400% is absolutely possible – even likely. A new oil-price bottom of $200 to $300 per barrel would present a nasty hurdle for the world’s economies… but if you can’t beat them, join them. Oil companies shouldn’t be the only ones that benefit from oil’s rising baseline. With the Casey Research energy team beside you, you can position your portfolio and join Big Oil on the ride.

As an investor being long oil is very sensible. As US politics will mean that the US will be badly prepared for the next oil crunch. Though the problem will be what will the US do to power its economy once that strikes. China is already preparing with green projects and will leave the US standing once there is a new oil crisis.

In the long run the oil price projections in the article may be accurate. But investors cannot invest over some vague “long run.” They must invest over specific time periods. A lot of smart people have lost their shirts investing long oil the past few years, and yet oil does tend upwards “in the long run.”

We can only hope that China over-extends itself with green projects. Green energy is better known as intermittent unreliable energy, upon which only a fool will rely. China is in enough economic trouble already, so that if it goes out on a limb for green projects, it would be slipping the noose around its own neck.

Yes a single renewable energy source can be intermittent, but as part of an integrated grid, with different forms of renewable, it can be a lot more reliable than a single plant. It might never make fossil fuels obsolete but combined the two will give fossil fuels a much longer lifespan than fossil fuels alone.

There are investors who can ride out the ups and downs of a volatile market. Longer term the oil market will hit new higher baselines. It is really only a function of time.