Subversive Economists

The economic research staff at the Federal Reserve Bank of New York has been busy. Last week we wrote about the New York Fed’s Staff Report No. 458 , which discussed the shadow banking system in the United States. Today we refer to two other new reports: Staff Report No. 457 , entitled “Resolving Troubled Systemically Important Cross-Border Financial Institutions: Is a New Corporate Organizational Form Required?”, and Staff Report No. 463 , “The Central-Bank Balance Sheet as an Instrument of Monetary Policy.” After reviewing them, we are left to conclude that these three papers demonstrate that the research staff at the New York Fed is perhaps the most subversive group of working economists currently on the government payroll.

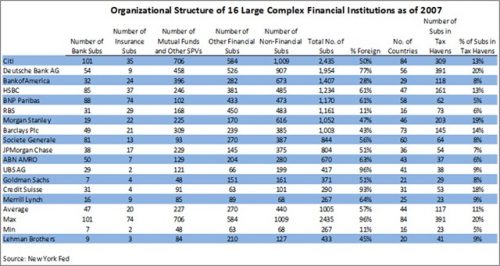

No. 457 examines the challenges of “large, complex, internationally active financial institutions,” primarily from a corporate governance perspective. The paper begins with a review of a commonly heard complaint that arose in the aftermath of the financial crisis of 2008. “Virtually all the principals in the U.S. involved in developing policies to deal with troubled financial institutions during the current final [sic] crisis have argued that they were handicapped in the options available to deal with large systemically important non-bank institutions like Bear Stearns, Lehman Brothers and AIG. They indicate that they were faced with relying upon 1) hastily arranged mergers, 2) traditional bankruptcy laws to resolve institutions, or 3) government injections of funds to enable troubled institutions simply to continue operating.” The authors, Christine Cumming and Robert A. Eisenbeis, contrast these very challenging resolutions with the relatively simpler resolutions of troubled depository institutions like Countrywide and IndyMac. The authors go on to propose a new, simpler financial charter for these kinds of organizations. The following table from the paper demonstrates the enormous complexity of the modern-day financial institution.

No. 463 is a dense paper that looks at the use of the Fed’s balance sheet as an instrument of monetary policy, particularly given the growth in liabilities (by the fall of 2008, bank reserves were 100 times larger than they had been just a few months before) and assets (the ballooning in mortgage-backed securities and a variety of other assets). The authors, Vasco Curdia and Michael Woodford, asked two important questions: “How should one think about the aims of these programs, and the relation of this new component of Fed policy to traditional interest-rate policy? Is Federal Reserve credit policy a substitute for interest-rate policy, or should it be directed to different goals than those toward which interest-rate policy is directed?” They conclude that such balance sheet maneuverings, whether quantitative easing or targeted asset purchases, are not good substitutes for monetary policy, but that asset purchases— particularly purchases of illiquid assets—can be useful in the event of financial market disruption or when the Fed Funds rate is at zero.

The combination of these three papers seems to suggest that the Federal Reserve is conducting a serious re-evaluation of its traditional role in the new financial landscape. No. 458 acknowledges that the shadow banking system is huge, but largely beyond the regulatory reach—and backstopping help—of the Fed. No. 457 suggests that the complexity of a large, modern financial institution is not only a challenge for managers, but is also a challenge for regulators. It is a cri de coeur for simplicity. And No. 463 breaks new ground by explicitly including central bank balance sheet management as a part of the monetary policy model.

These are subversive ideas for an ivory tower. All of these papers carry the legend on the front saying “The views expressed in this paper are those of the authors and are not necessarily reflective of views at the Federal Reserve Bank of New York or the Federal Reserve System.” We wonder about that. Nevertheless, the good news is that the Fed is thoughtfully approaching the changes and the challenges of the brave new world of global finance.

If they are going to buy assets what assets should they buy? Hopeful they won’t buy the assets that drove up the cost of housing beyond what American’s can pay. Additionally if they are going to buy these assets hopefully they will pay what they are actually worth rather then overpaying as was alleged of the US government:

“Five months later, the administration disclosed under intense congressional pressure that $13 billion had gone to pay 100 cents on the dollar on some of Goldman Sachs’s derivative bets, a payout that Neil M. Barofsky, the Special Inspector General for the Troubled Asset Relief Program (TARP) called a “back door bailout” for Goldman.”

https://www.theamericanscholar.org/too-bad-not-to-fail/

Perhaps buying an index fund would be more balanced but if they did this they would be accused of market manipulation but then again isn’t mucking with the interest rate market manipulation anyway?

Here’s a radical idea. They could invest in a company which buys up houses sold at bankruptcy auctions and rents them out. This way their would be a supply of cheap affordable rental accommodations for people that lost there home.