Bill Gross and the deficit ring of fire

Bill Gross is out with his latest monthly investment outlook. He is taking on the issue of sovereign debt. This is an issue that has moved center stage, especially in the wake of the surprise Thanksgiving debt moratorium announcement in Dubai.

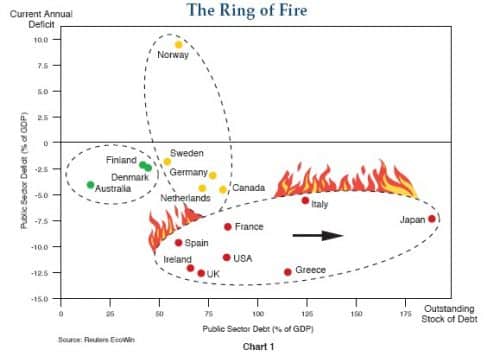

What caught my eye was this chart below.

The obvious implication of the chart is that there are three separate groups of sovereign debtors in the major industrialized world.

The first group has a relatively small current public sector deficit problem and low public sector debt. The implication is they will benefit from low yields as a result. Those are the bonds investors want to invest in as a safe haven. We’re talking Australia, Denmark and Finland.

A second group of countries has slightly higher public sector debt burdens. In general, though, this group does not have enormous current deficit problems. Therefore, the implication is they too are safe bets – although perhaps less so. This group includes: Canada, the Netherlands, Sweden, Germany, and outlier Norway which has benefitted from the North Sea.

The third group is the one to watch. This is where the problem children are. Public sector debt levels are higher and rising. Moreover, there are across the board current large and unsustainable deficit gaps within this group. The obvious implication is that debt from these sovereigns will underperform going forward.

The foregoing analysis dovetails with the Obama Administration’s recent turn to deficit hawkishness. However, the chart points out that it is the nexus of both present deficit spending and longer-term debt levels which makes for a problem. That is certainly why Obama’s recent deficit salvo is a superficial political stunt which does nothing to address these longer-term issues.

From a market perspective, you would want a relative value play of long Finland and Denmark but short Japan and Greece is the right read of this chart.

For his part, Gross says:

The Reinhart/Rogoff book speaks primarily to public debt that balloons in response to financial crises. It is a voluminous, somewhat academic production but it has numerous critical conclusions gleaned from an analysis of centuries of creditor/sovereign debt cycles. It states:

- The true legacy of banking crises is greater public indebtedness, far beyond the direct headline costs of bailout packages. On average a country’s outstanding debt nearly doubles within three years following the crisis.

- The aftermath of banking crises is associated with an average increase of seven percentage points in the unemployment rate, which remains elevated for five years.

- Once a country’s public debt exceeds 90% of GDP, its economic growth rate slows by 1%.

Their conclusions are eerily parallel to events of the past 12 months and suggest that PIMCO’s New Normal may as well be described as the “time-tested historical reliable.” These examples tend to confirm that banking crises are followed by a deleveraging of the private sector accompanied by a substitution and escalation of government debt, which in turn slows economic growth and (PIMCO’s thesis) lowers returns on investment and financial assets. The most vulnerable countries in 2010 are shown in PIMCO’s chart “The Ring of Fire.” These red zone countries are ones with the potential for public debt to exceed 90% of GDP within a few years’ time, which would slow GDP by 1% or more. The yellow and green areas are considered to be the most conservative and potentially most solvent, with the potential for higher growth.

Remember, however, there are the private sector debts as well – and as this downturn has shown, private sector debts can be foisted onto the public sector via the politics of privatized gain/socialized loss.

Source: The Ring of Fire – Investment Outlook, Bill Gross | February 2010

“… a deleveraging of the private sector accompanied by substitution and escalation of government debt, which in turn slows economic growth (PIMCO’s thesis) …”

Also Minsky’s thesis twenty-five years ago, except the “in turn” part, which conceals the fact that the government is backstopping whatever private banking institutions “innovate.” So the private actors run up the debt bill, the economy goes into crisis, the government bails it out, and it blows up the debt balloon. What is not clear in my cursory reading is the fact that the situation is progressive.

Also dovetails with Soros’ superbubble.

So, then, the answer is to ….?

Write down the debt, move credit into productive assets in the public sector, and let the private actors who played cowboy deal with the fact they ran their horse to death.

Agreed. That is good Keynesian policy. The bad form is what we are now seeing where the private actors who played cowboy get a new horse.

Bill Mitchell at billyblog.com had some things to say yesterday about the Reinhart/Rogoff book — https://bilbo.economicoutlook.net/blog/?p=7567…

This is completely correct.

Somewhat off topic since I am talking about Russia here but there case is instructive in regards to default:

I said a few months back:

https://pro.creditwritedowns.com/2009/11/russia-sovereign-debt-defaults-and-fiat-currency.html

America has no foreign currency debt to speak of. There is no default risk. There is inflation risk yes, interest rate risk yes, currency depreciation risk. But that is all.