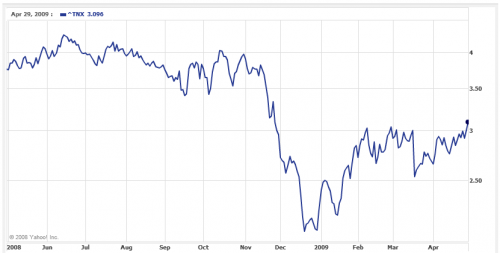

Treasuries are getting crushed

Ten-year treasuries are yielding about 3.15% now, that is a significant increase from a yield of just over 2% in December. I for one, thought that Treasuries were in a bubble at 2% (See my post, “Treasurys are in a bubble” from December 08). The thing is I also thought the economy was so weak and the Fed so manipulative that the bubble would get even worse. Bad call. Of course, that didn’t happen.

Not that I was long Treasurys. It is better to have owned TIPS as a hedge against inflation, I argued in early January. And this is exactly what we have seen. A lot of analysts missed the big news in the GDP data yesterday. So let me reiterate my sentiments from yesterday here. It’s called inflation.

Nominal GDP. Nominal GDP itself decreased at a 3.5% annualized rate versus Q4. This compares to a 5.8% decrease in Q4 2008 over Q3 2008. Translation: the nominal slowdown was much less in Q1 than Q4 2008. The similarity in Q4 2008 and Q1 2009 real GDP data is explained wholly by changes in the GDP Deflator (there was a huge increase in the price index for non-durable goods in Q1).

So, my question is this. Are treasury yields rising because of:

- A reflation play i.e. inflation is coming?

- A recovery play i.e. we are seeing green shoots and that’s bearish for Treasurys?

- A Fed play i.e. Bernanke is not going to do any more quantitative easing, or at least not enough to stop rates from rising?

- A revulsion play i.e. too much debt is being issued?

Irrespective of why yields are rising, it’s not good for a potential recovery.

Yields are rising because of over-supply. This is more or less the same thing as what causes inflation (i.e you could say ‘Yields are rising because inflation is expected to rise’ and that would be just as correct) and was pretty much a foregone conclusion from December 2008 onwards, the same in the UK.

It took me until March to get round to opening a futures account so I could do short-selling but it’s bad for my nerves and I haven’t made as much as I would have if I had just sold one contract short and left it open.

Treasuries look soft because of huge supply not only in the U.S. but elsewhere. But, every countries bonds are getting whacked. The U.S., Gilts, Bunds, JGBs, you name it. So while stocks are rallying, bonds are tanking. And it is more at the long end of the curve than the short end. To me this spells a recovery play and inflation as well.

Brad Setser showed some data early in the year that suggested China shifted a massive amount of their agency holdings to treasuries about the same time that the big treasury rally occurred (December?). This was also right when deflation first became visible for those who only look for it in CPI/PPI type numbers, which probably scared a lot of other people into treasuries in the short term, before government responses became even larger and stoked new fears of inflation. So in hindsight I think treasuries got way ahead of themselves.

As to why yields are rising now? I’d guess all four of the factors have merit in the opinion of the markets (whether or not these factors will ultimately prove to be correct).

I just finished a draft of a writeup on thoughts on treasuries that I was initially just going to share with a couple friends, but this seems like the right opportunity to ask for other feedback on it. If it’s not too long or rambling to read, I’d love feedback on where you think I’m wrong, especially on the balance sheet portions. I already know you potentially disagree on the inflation prospects.

Also, it would be great some time if you’d supplement your tutorial on write-downs with a piece explaining precisely how loan loss reserves work from a balance sheet perspective.

I am the most bearish on Japanese government bonds because the savings rate in Japan has plummeted. Contrary to any myth, they are not large savers anymore. Also, foreign overcapacity (which increased when asian nations ran large trade surpluses. I suppose one reason for this was this would protect themselves from what happened to Thailand ) would reduce the earning power of Japanese workers so they would have less income to save. They also have a large government debt relative to their GDP, too. Yields would also go higher there because the yields on other foreign denominated assets would be attractive.

I am somewhat bullish on German bonds because I think the returns on capital in Germany would be lower when the dollar weakens. Also, they are more likely to accept deflation. Deflation isn’t that bad when you have a welfare state and a low gini coefficient where most people suffer equally. In addition, let’s not forget the effects of hyperinflatino and the subsusqent rise of Hitler.

Regarding the fear of oversupply. Do you have any information about the shares outstanding in TBT. I’ll use that as a proxy for Treasury sentiment. If it is high, I would say the risk/reward for going LONG on treasuries would be attractive. Higher yields mean less duration risk. I do not think a default would happen unless a country like Italy defaults first.

“A reflation play i.e. inflation is coming?

A recovery play i.e. we are seeing green shoots and that’s bearish for Treasurys?

A Fed play i.e. Bernanke is not going to do any more quantitative easing, or at least not enough to stop rates from rising?

A revulsion play i.e. too much debt is being issued”

I would be against the first two. The third seems like a good possibility, and when things get worse, Bernanke would print.

The fourth seems to be a legitimate concern.

I thought that when Bernanke made that annoucement yields would go lower for a few weeks. It would be similar to what happened to the Japanese bond market in 2003.

The bond market is smarter than the equity market.

I suppose the reason for high yields is reason #4.

Sorry for three posts in a row.

Also, potential wave of protectionist retaliation (if global policy makers choose protectionism) seems to benefit German bonds since they are an export driven economy, and that would make their export sector less profitable. It would also reduce the returns on equity as a lag in their export sector should spread to the domestic sector. I suppose that is another potential upside to Bunds.

I do not think the US will lead in promoting protectionism because it is does not benefit the elite. But, of course, support for protectionist policies would increase in the US.

However, the equity market does not see what the effects of higher Treasury yields are. (It should decrease the value of equities since the discounted cash flow of the yields would have a higher discount rate attached to it.) I suppose it is dominated by short-term traders and managers who care about status because they have to compete with other traders. The nature of fixed-income (since they are long term instruments and have less potential upside) deters this type of irrationality.

My bet is on the decline of the purchasing power of the USD. Buy gold and silver and pick up shares of cash rich oil companies with reserves in politically stable areas.

There are people over at Seeking Alpha too saying why Treasuries are tanking https://tinyurl.com/cxhnc7. I pose the question, but I obviously don’t have the answer yet